100% GST AccountRight

- 3 years ago

Hi Colleen

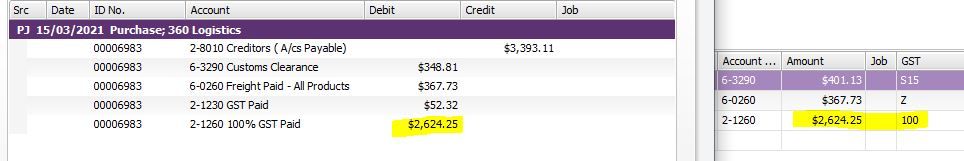

Generally speaking, the GST Amounts listed on the GST [Summary - Invoice] report would correspond with what is showing on the GST information window. This is the one accessed by selecting the GST arrow next to the GST Amount (bottom right of the transaction) and shows the breakdown of GST values.

For the transaction that you have provided, I would expect to see the following located in that GST Information window:If you are showing a different value in that GST [Summary -Invoice] report my advice would be to review the GST Information window and recalculate the data. This will ensure that values have not been overridden in that process. If it is still occurring with that report clearing the cache would be the recommendation.