Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- The AccountRight Blog

- >

- AccountRight 2014.3 now available (Aussie complian...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

AccountRight 2014.3 now available (Aussie compliance update)

This AccountRight compliance update for Australian businesses includes the 2014/15 tax tables, and everything you need to keep your business payroll-compliant.

Actually, we’ve got something for everyone, even if your AccountRight doesn’t have payroll features (just skip the “Payroll updates” section to see what’s new for you).

The following information is for users of AccountRight 2011 or later. If you use AccountEdge v13 or AccountRight v19, we’ve got a compliance update for you that includes the changes listed below, except for the Pay Superannuation and ABN checking features. If you haven’t already updated, check your inbox for an email that explains how to get your hands on the update, or visit myob.com.au/EOFY.

Payroll updates

[For AccountRight Plus and Premier only]

Keeping up with the ATO’s ever-changing requirements for employers can be a real challenge, but we’ve done the hard work for you, and included all the changes that apply from 1 July 2014 in this compliance update.

Up-to-date tax tables

There have been quite a few changes to the PAYG tax rates, and the Medicare levy rate has increased. You need to load the new tax tables that are provided with AccountRight 2014.3 to ensure your pays calculate correctly.

While you can install this update at any time, you should only load the tax tables after closing your 2014 payroll year, and before your first pays for July.

Here’s how to load the tax tables

- Install the AccountRight 2014.3 update.

-

Open your company file.

-

Go to the Setup menu and choose Load Payroll Tax Tables.

-

Click Load Tax Tables.

-

Repeat for your other company files.

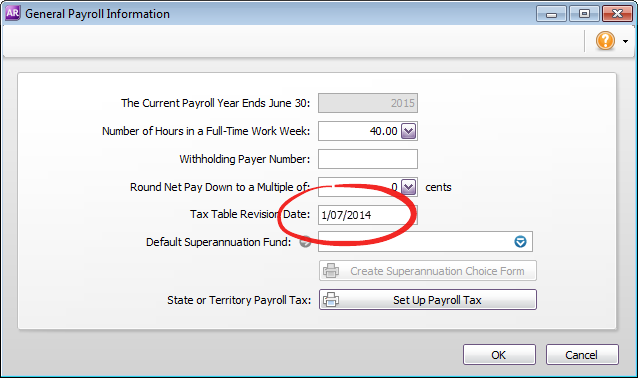

Want to check you’ve got the latest tax tables? Go to the Setup menu and choose General Payroll Information. The Tax Table Revision Date should be 01/07/2014.

Tip: The Mature Age Worker and Dependent Spouse tax offsets aren’t available for the 2014-2015 payroll year, so if an employee has been claiming these tax offsets, you might need to adjust the Total Rebates amount in their card.

The super rate’s increasing again

From 1 July 2014, the superannuation rate is 9.50%, up from 9.25%. When you close your 2014 payroll year, we’ll help you update the relevant super payroll categories for the new rate, ensuring your employees get the right rate from day one.

It's here! With Pay Superannuation, you can now make super payments directly from AccountRight, meet your employee super obligations in a flash, and stay on top of government changes. And the best bit? It’s free with your AccountRight subscription! Learn more.

Payment summary changes

The ATO has made a small update to the Employment Termination Payment fields of the payment summary form. As per last year, when ETP payments are made to an employee, you need to select the appropriate benefit code, but this year, the S and P codes are listed under the new Multiple option. It’s a slight change, but one to be aware of when preparing your payment summaries.

NEW! Supplier ABNs automatically checked for you

[Not available in AccountRight Basics]

When a supplier quotes you their ABN, you should check that it’s legit, valid, and registered for GST. You could check it manually by visiting www.abr.gov.au, but we’ve made it heaps easier for you.

When adding a supplier card to your company file (and every time you open their card), we’ll automatically check their ABN with the Australian Business Register. If all’s good, you’ll see a green icon next to the ABN field. Hover over the icon to get all the details. Any issues (like an invalid or cancelled number), and the icon will turn amber.

You’ll need an active AccountRight subscription and an internet connection to use this service.

Fewer errors, more help

In this update we've made AccountRight a lot more stable for you. We've also fixed the customer card issues that affected AccountRight Basics 2014.2 users. So ensure you update to keep AccountRight in tip-top shape.

But if something does manage to close AccountRight unexpectedly, we'll try to give you helpful information about the issue. We’ll guide you to a Support Note that has information about the possible cause of the crash and if known, a solution to prevent it from reoccurring.

Get the update

The 2014.3 update is rolling out over the next few days to all clients who have an MYOB AccountRight or Cover subscription in Australia. Here’s how you can get it:

If you’re using:

- AccountRight 2013.2 or later: You’ll see the prompt to update when you open your company file.

- AccountRight 2011 to AccountRight 2013.1: Go to Start > Software Updates. Haven’t registered for software updates? See Support Note 32270.

- AccountRight v19 or earlier: Learn how to download the update.

If you have any problems downloading your update, you can access it from my.myob.com.au.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.