Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- The AccountRight Blog

- >

- Better BAS management

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Better BAS management

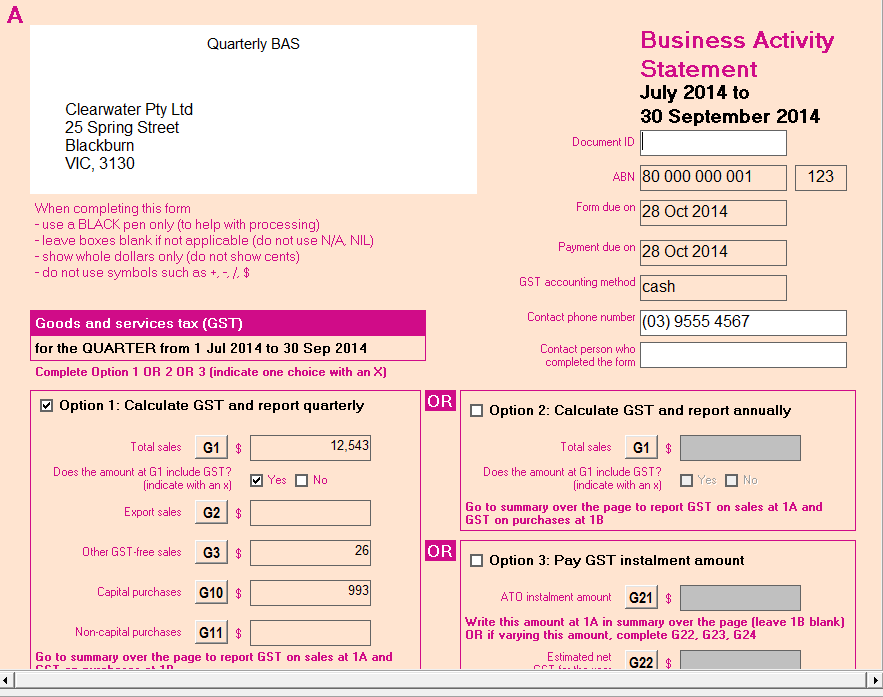

BAS time in Australia always seems to roll around faster than you’d like, and if you lodge your BAS quarterly, your first BAS for 2014/2015 is due on 28 October.

Your due date is written on the top of your BAS, but the ATO website has a helpful guide to lodgement dates on their website, just if you need a reminder.

Before you start doing your BAS, it’s a good idea to check that all the information you’ve entered over the quarter is correct. An easy way to do this is to use the Company Data Auditor to reconcile your Tax.

This video shows you how easy it is to reconcile your tax and what you might need to look out for.

When you’re happy that the information is correct, you can lodge your BAS. AccountRight has BASlink, a feature that helps you prepare and lodge your BAS.

There’s information on how to set up BASlink in our online help, and this support note.

Quick tip

Confirm the following with your accountant or MYOB consultant before setting up BASlink:

- when you report your BAS (quarterly or monthly),

- what you need to report (GST, PAYG instalments, FBT considerations), and

- whether you report Cash or Accruals (that’s basically whether you report GST to the ATO when you make a sale - Accrual, or when you actually get paid for the sale - Cash).

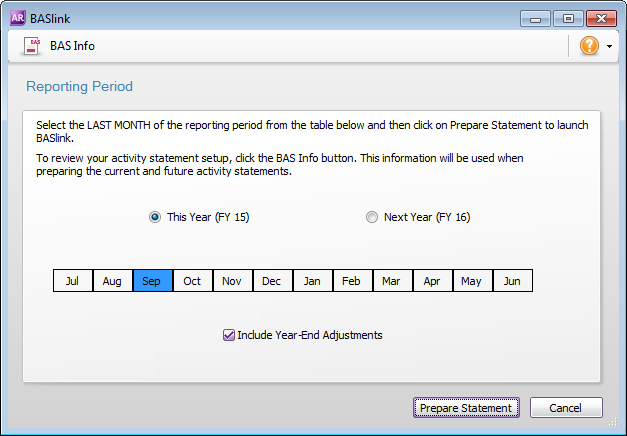

After you’ve set up BASlink, each time you need to complete a BAS, you can simply select the last month of your reporting period and click Prepare Statement.

AccountRight will fill in the details of your BAS for that period.

BASlink shows you everything you need to fill in on your BAS, making it really easy to lodge your return. You can find out more about how to lodge in the help.

The ATO gives you options to lodge your BAS electronically through the Business Portal. Lodging electronically may give you extra time to lodge and pay your BAS. Find out more on the ATO website.

Common GST mistakes in BAS reporting

If you can’t figure out where you’ve gone wrong with some BAS reporting, this blog post by Amanda Hoffman, founder of My Office Books and registered BAS agent may just sort you out.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.