Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- The AccountRight Blog

- >

- Don't fudge it, budget!

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Don't fudge it, budget!

It’s not the most glamourous aspect of running a business, but it’s certainly one of the most important if you’re hoping to continue being in business. Today we’re talking budgeting.

Now, normally we’d recommend setting budgets when you start a new financial year, but better late than never, (if you’re in Australia set budgets for the next 6 months) so get onboard with making 2015 the year of budgeting.

Why should I create a budget for my business?

Budgets are important for a number of reasons (and yes, placating your accountant may be the first one that comes to mind). When you prepare a budget, you’re predicting the financial state of your business – are you spending more than you’re earning? Are you spending enough to make sure your small business can grow? Do you have enough cash to pay what you owe to the tax office?

Budgets are a great way to keep control over your cashflow – giving you insight into which months are good for sales and which aren’t. Which months you have more or bigger expenses, so you can make sure you have enough cash on hand to cover them.

Monitoring how your business is tracking to your budget means you’re more likely to see potential issues, and make decisions to get back on track before it gets out of hand.

See, lots of great reasons for setting up budgets, but how do you get started? Thankfully AccountRight has a great budgeting feature, so you can learn to love budgeting in no time.

How do I create a budget in AccountRight?

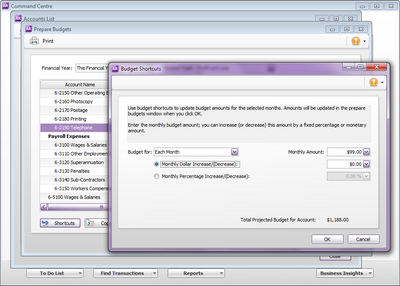

Get started from the Accounts command centre. Click Accounts List, then Budgets.

You can create a budget for the current financial year, or the next financial year (Get started early, NZ!)

You can create a Profit and Loss budget (which deals with your income, expenses and cost of sales), or a Balance Sheet budget (which deals with your assets, liabilities or equity account.)

Then it’s just a case of entering the budget figures for each month. (Try our online help for more detailed instructions).

While I can’t tell you what figures to enter for each month, I can give you a couple of handy tips to help you become a budget entering pro in no time.

The Shortcuts button

You can thank me later for introducing you to this little gem.

Say you have a cap on the mobile plan that you use to run your business, so every month you spend the same amount – don’t worry about entering $99 in every month, just select the telephone expense account, click Shortcuts, and enter it for every month at once.

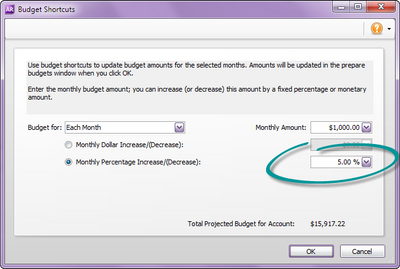

Impressed? This next shortcut’s even better.

Say you plan to increase sales by 5% every month, you can do that in the shortcuts too. Enter the first month amount, then set it to increase each month.

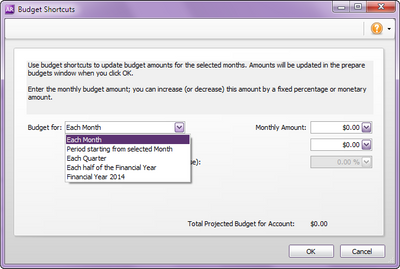

The budget shortcuts also let you enter budgets for just the next three or six months (handy if you’re just getting into this budgeting thing), or set quarterly or half yearly budget amounts.

Copy options

Copying is a great timesaver with budgeting. Whether you’re copying amounts from one month to another, or copying details from last year to the new year.

Import budgets

Want to import budgets from another file or different software program? The Import Assistant may be able to help you import the budget information into AccountRight.

Check what types of files you can import into AccountRight.

Reviewing your budget

Of course, the best bit about budgeting is checking how you’re going against your budget. It’s good practice to compare at least monthly. That gives you the ability to make adjustment if you’re starting to differ wildly from where you planned to be. Be aware that a slight variation from the budget is normal.

You can compare your budgeted amount with actual account balances by viewing the Budget Analysis reports under Profit and Loss reporting, or Balance Sheet reporting.

So make this year the year of the budget and get started getting better insights into your business with AccountRight.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.