Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- AccountRight: Payroll

- >

- Entering unpaid breaks in payroll and on Payslips

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Entering unpaid breaks in payroll and on Payslips

Some of the links and information provided in this thread may no longer be available or relevant.

If you have a question please start a new post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

March 2021 - last edited March 2021

March 2021 - last edited March 2021

Entering unpaid breaks in payroll and on Payslips

Please suggest the best way for me to record unpaid meal breaks when processing payroll. I would like to show it separately on the payslips rather than deduct it from Base hourly.

I am wondering if I could create a payroll category and call it 'Unpaid meal break' or "Smoko' and then enter it as a negative (eg: -2.5 hrs) If so, would the ATO reporting category be Gross Payments or Not Reportable?

Please note we use a different app for timesheets and I enter the hours manually on payday, so this would be a good way for me to keep a 'paper trail'

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

March 2021

March 2021

Re: Entering unpaid breaks in payroll and on Payslips

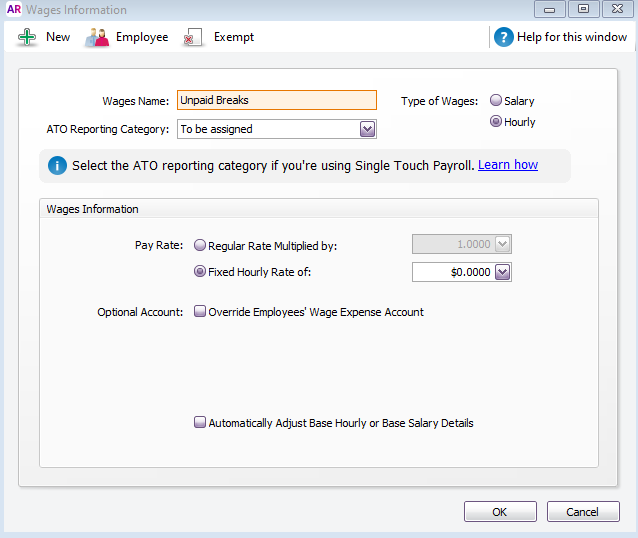

Thanks for your post. You could create a new payroll category and enter negative hours. Or you could create a new payroll category and set the Pay Rate as Fixed Hourly Rate of $0.00:

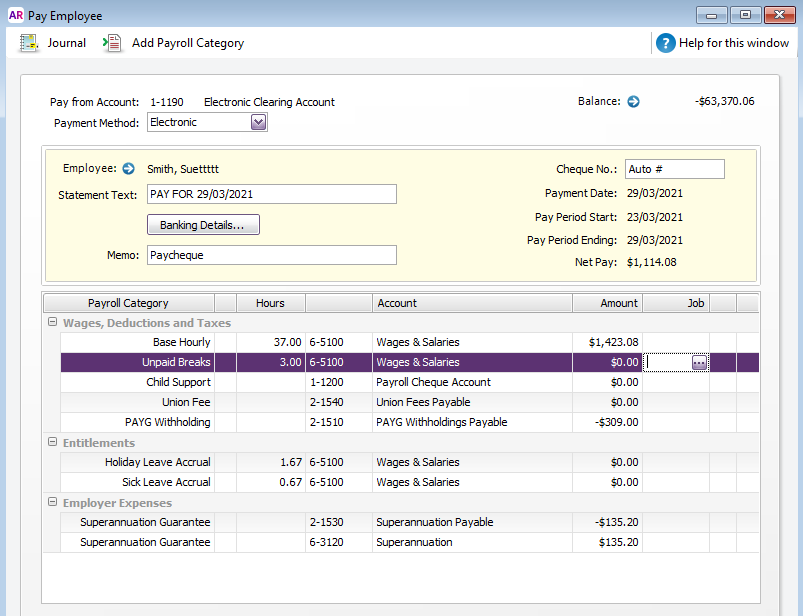

When processing pays, allocate the actual hours worked to base hourly and the unpaid break hours to the unpaid breaks payroll category:

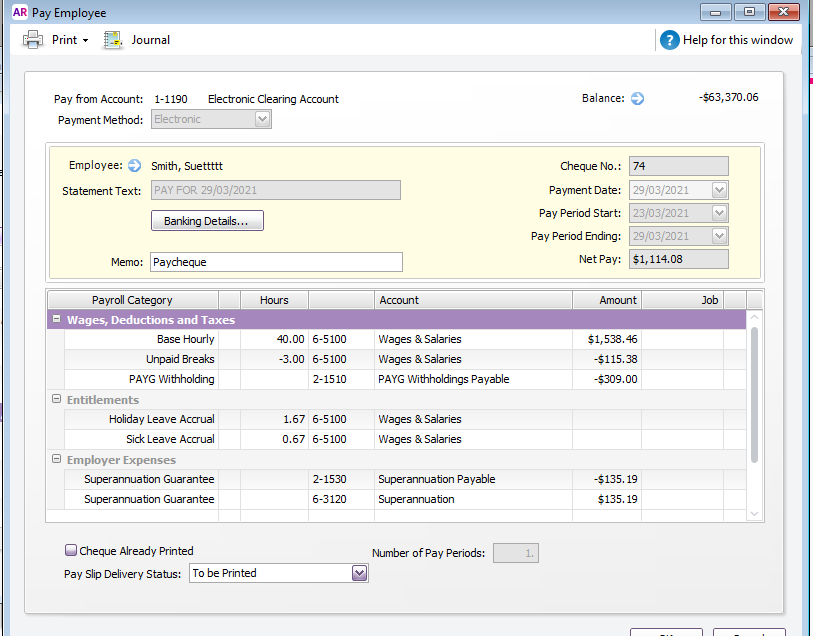

Entering the unpaid breaks as a negative amount will give the same pay, but it adds another payroll category to reconcile. You'll also need to make sure it is set up correctly for super and leave entitlements.

If you're not sure about the ATO reporting category I do recommend checking with the ATO or your accountant. Generally speaking if you want to include a payroll category in gross wages you would select that reporting category. For example if you entered the unpaid breaks as a negative figure the base hourly figure is higher. This means that the YTD gross wages amount is higher and needs to be reduced by the unpaid breaks amount. Assigning Gross wages to the Unpaid Breaks category in this case will include the negative amount and reduce the YTD Gross Wages in STP.

If you chose to enter the unpaid breaks as 0 hours, the gross wages is already reduced to the actual amount paid. So you don't need to report the Unpaid breaks category as it is 0 and doesn't affect the gross wages amount.

Please let me know if you need further help.

If my response has answered your enquiry please click "Accept as Solution" to assist other users find this information.

Cheers,

Tracey

Previously @bungy15

MYOB Community Support

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Mark it as a SolutionHelpful? Leave a to tell others

Didn't find your answer here?

Related Posts

|

7

|

750

|

|||

|

1

|

595

|

|||

|

12

|

861

|

|||

|

by

91

1691

|

91

|

1691

|

||

|

10

|

1052

|