Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Installing and upgrading

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountant & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- AccountRight: Payroll

- >

- STP issues - Non reportable Exempt Fringe Benefits

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

STP issues - Non reportable Exempt Fringe Benefits

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

February 2023

February 2023

STP issues - Non reportable Exempt Fringe Benefits

I'm having issues with the STP 2 reporting to ATO for exempt fringe benefits.

Since the transition to STP 2, i noticed that the exempt benefit got reported to ATO in the MYOB software even though the deductions for exempt benefit had been assigned as Not Reportable in the ATO Reporting Category.

Previously, in the old STP reporting, it was not reported. I'm aware that it should not be reported.

How can we fix this issue? Has anyone gone through the same situation?

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

February 2023

February 2023

Re: STP issues - Non reportable Exempt Fringe Benefits

Hi @Jennifer_S

Welcome to the Community Forum. I can see from your account that you were able to speak to our inbound support team regarding this.

I trust that this query has been sorted.

If my response has answered your enquiry please click "Accept as Solution" to assist other users find this information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June

June

Re: STP issues - Non reportable Exempt Fringe Benefits

Hi

Just wondering if you had this sorted and if so, how please? I have just discovered the same issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June

June

Re: STP issues - Non reportable Exempt Fringe Benefits

It's now required by ATO that exempt fringe benefits be reported under STP 2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June

June

Re: STP issues - Non reportable Exempt Fringe Benefits

Hi @Maryann_H

Thanks for your post. Please allow me to extend you a very warm welcome to the Community Forum. I hope you find it a useful tool.

Our article Reportable fringe benefits amounts (RFBA) with Single Touch Payroll reporting will provide you with more information and instructions to assist you with this.

We do recommend confirming with your accountant or contact the ATO regarding ATO category based on your business set up and reporting needs.

Please let me know if you need further help.

If my response has answered your enquiry please click "Accept as Solution" to assist other users find this information.

Cheers,

Leneth

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Accept it as a Solution

Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

July

July

Re: STP issues - Non reportable Exempt Fringe Benefits

Hi there,

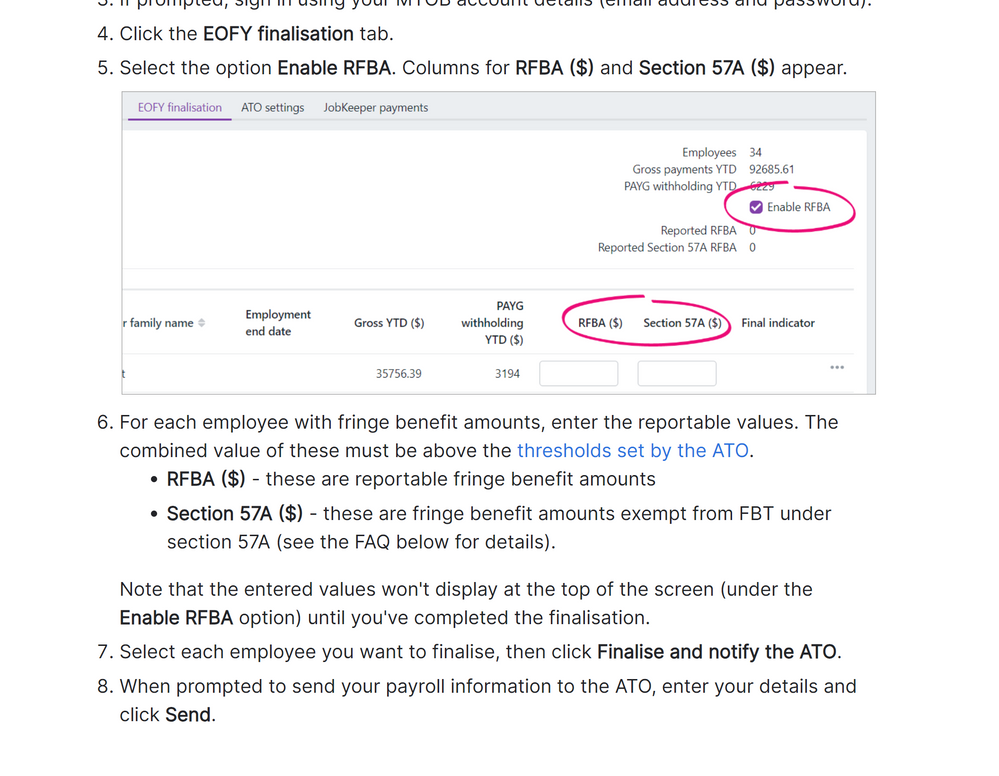

I've the same issue here where I need to report exempt benefits, from ATO website it says we need to report under SSA (Salary Sacrifice Arrangement), under salary code/type "O" - Other, but I don't know how to do this in MYOB, as the benefits need to be reported in the gross amount but not attracted to PAYG tax, so how do I report this in the EOFY final report? I can see there is a togle in the EOFY finalisation screen called 'Enable RFBA', can I report the exempt benefits in the Section 57A or where shall I report these figures? Any help would be great and thank you in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

July

July

Re: STP issues - Non reportable Exempt Fringe Benefits

Hi @MMZZ_2018

Thank you for your post.

You can set up salary sacrifice payments for employees who want to make additional superannuation contributions each pay. These payments are deducted from the employee's gross pay and will be on top of the compulsory superannuation contributions you make on your behalf. You can check our Help Article: Set up salary sacrifice superannuation, this includes more details and also includes the process that serves as your guide.

You can also check this Help Article: Reportable fringe benefits amounts (RFBA) with single Touch Payroll Reporting.

Let me know if you need further assistance with this. I'm happy to assist.

Are you satisfied with the response provided?

Thanks

Cel

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Accept it as a Solution

Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

July

July

Re: STP issues - Non reportable Exempt Fringe Benefits

Can I please have the phone number for the helpdesk helpline. The number I have appears to be discconnected. Still reporting incorrectly to ATO and need it urgently fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

July

July

Re: STP issues - Non reportable Exempt Fringe Benefits

Some of our employees are entitled to Non Taxable fringe Benefits that were previously non reportable.

I see on the payment summaries now that they appear as reportable...

I have set them up as - "Salary Sacrifice - other employee benefits" but they are appearing as RFB..

Is this correct? Will it affect the employees Govt benefits eg: family benefit or child care?

How do I fix it if its wrong...? who can advise me?

thanks Kim

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

January

January

Re: STP issues - Non reportable Exempt Fringe Benefits

Did you ever figure this one out?

I am in the same position and need to have the exempt benefits amount deducted from the EOFY finalsation and the RFBT button does not do this with th ATO

Didn't find your answer here?

Related Posts

|

1

|

152

|

|||

|

1

|

588

|

|||

|

1

|

348

|

|||

|

32

|

852

|

|||

|

14

|

833

|