Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- AccountRight: Payroll

- >

- Salary sacrifice into super - GL treatment

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Salary sacrifice into super - GL treatment

Some of the links and information provided in this thread may no longer be available or relevant.

If you have a question please start a new post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

May 2019

May 2019

Salary sacrifice into super - GL treatment

Hello everyone,

I have a few employees using salary sacrifice into super in a few of my MYOB entities. I appears that salary sacrifice into super, when setup in MYOB recommended way, treats salary sacrifice as a payment deduction rather than an expense under a different GL account, so when, for example, all $X of salary is sacriced into super MYOB sets up the following entries in the GL:

1-1220 Electronic Clearing Account 0 (CR)

6-1400 Wages Expenses $X (DR)

2-1420 Superannuation payable $X (CR)

What I would like to see is -

6-1500 Superannuation Expenses $X (DR)

2-1420 Superannuation payable $X (CR)

This would make it easier to reconcile payroll/TB/ATO reported numbers, in particular because salary sacrificed amounts are not a part of the gross wages.

I wonder how I could setup salary sacrifice to achieve that. There is no option to select an expense account under Salary sacrifice payroll category.

Any advice is appreciated.

Mike

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

May 2019

May 2019

Re: Salary sacrifice into super - GL treatment

Hi @Michael_H

The journal entry below recorded in MYOB is correct. The Salary Sacrifice is not an expense to your business. The Gross Wagess is the expense.

1-1220 Electronic Clearing Account 0 (CR)

6-1400 Wages Expenses $X (DR)

2-1420 Superannuation payable $X (CR)

Your suggested journal below is incorrect and the GROSS wages must be recorded and reported to the ATO otherwise their payment summaries will be incorrect.

If I am responding to your query and I have helped you please kindly mark my post as a solution to assist others in the future.

Warm Regards

Renae

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

May 2019 - last edited May 2019

May 2019 - last edited May 2019

Re: Salary sacrifice into super - GL treatment

Hi @CloudMindAcc ,

Thank you for your input.

ATO specifically prescribes that salary sacrifice into super is not to be included into Gross payments, and requests to report it under 'Reportable Employer Super contributions' , see -

https://www.ato.gov.au/Forms/PAYG-payment-summary---individual-non-business/?page=2

That's why I would prefer to treat it as a Superannuation expense, rather than Salary expense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

May 2019

May 2019

Re: Salary sacrifice into super - GL treatment

Hi @Michael_H

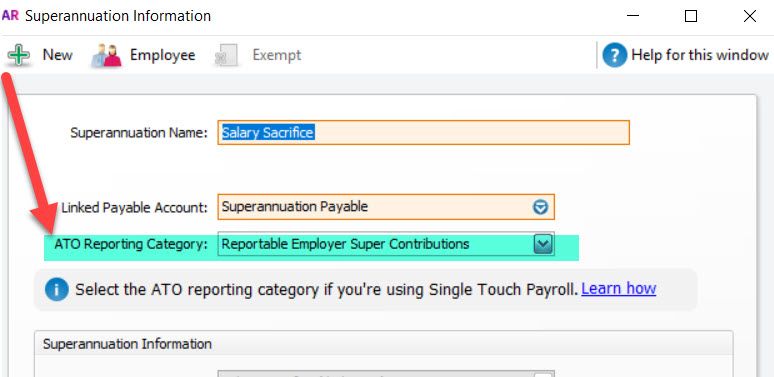

Salary Sacrifice is reported under the STP ATO reporting category as Reportable Employer Super Contributions.

Refer below:

If I am responding to your query and I have helped you please kindly mark my post as a solution to assist others in the future.

Warm Regards

Renae

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

May 2019

May 2019

Re: Salary sacrifice into super - GL treatment

Hi @CloudMindAcc ,

I assume it does report correctly, and it means that GL expense of wages in MYOB is not equal to Gross Wages reported to ATO - and this is where I can see the reconciliation problem. Do you know if there any way to run a report on Salary sacrifice transactions and amounts?

Thanks again for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

May 2019 - last edited May 2019

May 2019 - last edited May 2019

Re: Salary sacrifice into super - GL treatment

Hi @Michael_H

ATO+reporting+categories+for+Single+Touch+Payroll+reporting#expand-Superannuation

Reference in support note states:

Did you previously report salary sacrifice amounts on payment summaries? You don't need to assign the Gross wages category to salary sacrifice amounts. When reporting payroll amounts using Single Touch Payroll, gross wage amounts are reduced automatically by deduction amounts that are marked as a before-tax deductions. This includes salary sacrifice superannuation deductions.

Note that you assign the Reportable Employer Super Contributions (RESC) category to superannuation categories which handle 'reportable' superannuation payments (as classified by the ATO guidelines).

Below is a report that will help you review the Salary Sacrifice Transactions. You could save as a customised report so you can just run each month/quarter (changing the dates)

If I am responding to your query and I have helped you please kindly mark my post as a solution to assist others in the future.

Warm Regards

Renae

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

May 2019

May 2019

Re: Salary sacrifice into super - GL treatment

Thanks, this report is a workaround as the amounts could be manually adjusted in GL thus reconciled with the reported amount. [I wish MYOB would have a bit more flexibility as many other systems.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

May 2019

May 2019

Re: Salary sacrifice into super - GL treatment

Hi @Michael_H glad I could help you. Another option (if you don't already do this) is I reconcile the Superannuation Payable Liability G/L account quarterly or monthly back to zero in the bank reconcilation screen. This will highlight if a user has posted a transaction directly to the G/L account and any discrepancies.

If I am responding to your query and I have helped you please kindly mark my post as a solution to assist others in the future.

Warm Regards

Renae

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June 2019

June 2019

Re: Salary sacrifice into super - GL treatment

You are absolutely correct, Salary sacrificed super from Gross Wages is a deduction to the company as Superannuation Expense NOT Gross Wages & is reported as RESC in the PAYG Summary as such. MYOB does this incorrectly and should simply allow for the the Salary Sacrifice "type" to allow those amounts to be processed to Super Payable & Super Expenses but reduces the overall PAYG deducted from the reduced Gross Wages for the employee, otherwise you will overstate their Gross Wages for the year, unless you are particular to exclude the Salary Sacrifice Super category from the total Gross Wages when preparing the PAYG Summaries. Every Payroll report should reconcile and reflect the RESC amounts, but just makes it complicated with this process.

Didn't find your answer here?

Related Posts

|

3

|

274

|

|||

|

12

|

2086

|

|||

|

9

|

2599

|

|||

|

2

|

1046

|

|||

|

0

|

904

|