Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Installing and upgrading

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountant & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- AccountRight: Payroll

- >

- Re: Super Calculations on MYOB AR Live Plus 2019.3

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Super Calculations on MYOB AR Live Plus 2019.3

Some of the links and information provided in this thread may no longer be available or relevant.

If you have a question please start a new post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

October 2019

October 2019

Super Calculations on MYOB AR Live Plus 2019.3

Good afternoon,

Just upgraded and noticed the Super calculations are out - seems to be because of a Payroll Category called LAHA (living away from home allowance) that I marked as exempt from Super. It is $504 per week

Doing manual calculations I notice that when it is marked exempt, the Super is exactly 9.5% of $504 too low (it seems to DEDUCT LAHA from Gross Wages - I don't want it to deduct it, just not include it in Gross Wages.

However when I tried un-exempting LAHA from the Super set up screen, it then adds 2 x $504 and calculated Super on that plus Gross Wages / Normal Time earnings.

For now I am manually overiding Super calcs.

Thank you

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

October 2019

October 2019

Re: Super Calculations on MYOB AR Live Plus 2019.3

Hi @Shilolilo,

Thank you for you post, I hope your finding helpful information on the Community Forum.

Can you please provide me a screenshot of the following;

- LAHA entitlement category

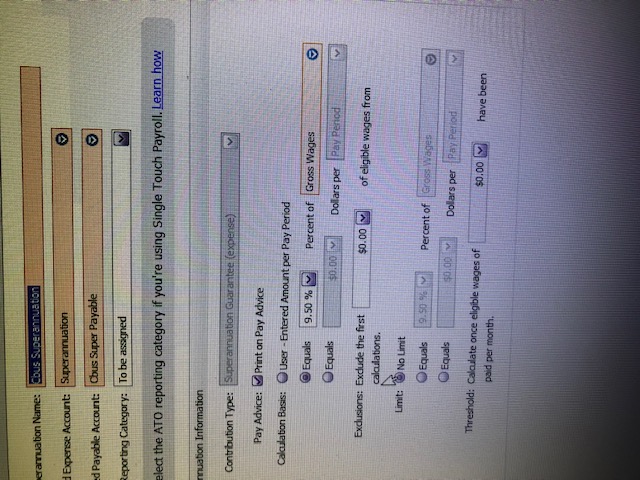

- Screenshot of the Superannuation category set up

(Note, please hide any sensitive information)

Cheers,

Melisa

MYOB Community Support

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Mark it as a SolutionHelpful? Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

October 2019

October 2019

Re: Super Calculations on MYOB AR Live Plus 2019.3

Thanks for your reply,

here is the super set up and I have also posted the exemptions screen...and LAHA set up screen - this LAHA category is marked as PAYG exempt also,

Shilo

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

October 2019

October 2019

Re: Super Calculations on MYOB AR Live Plus 2019.3

Hi @Shilolilo,

Thank you for the screenshots, I have taken a look into them and need to investigate further.

Are you able to provide me a screenshot of when LAHA is exempted from super and the payrun where you think the super calculation is too low ? And a screenshot of the Super entitlement category. (Note, please hide any sensitive information)

Cheers,

Melisa

MYOB Community Support

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Mark it as a SolutionHelpful? Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

October 2019

October 2019

Re: Super Calculations on MYOB AR Live Plus 2019.3

Hi,

Sorry for the late response.

I have been noticing during this weeks payroll that before I input data into the pays (the default payslip starts with basic 38 hours) the Super is incorrect in some instances. I don't know how it can be the super set-up as it happens with some people and not others who have the same CBUS Super set up applied to their card file.

Here are 3 screen shots - one of the basic paylsip before I enter anything - the Super should be 9.5% but is being calculated at 4.6%,

Have also attached screenshots of CBUS Super set up.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

October 2019

October 2019

Re: Super Calculations on MYOB AR Live Plus 2019.3

Hi @Shilolilo,

Thank you for the screenshots. Can you please go to the Superannuation payroll category > Open up Cbus superannuation > There will be a button for Exempt at the top of the window, can you please click on exempt. Can you confirm if the 'Base hourly' wage category has been ticked in here ?

Cheers,

Melisa

MYOB Community Support

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Mark it as a SolutionHelpful? Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

October 2019

October 2019

Re: Super Calculations on MYOB AR Live Plus 2019.3

Hi,

No it wasn't ticked as exempt.

We are not having an isse with new employees I have set up since upgrading, but the employees that were current pre-upgrade mostly have this problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

November 2019

November 2019

Re: Super Calculations on MYOB AR Live Plus 2019.3

Hi @Shilolilo

Just wanted to jump into the conversation to see how you're going with this. Were you able to get the figures sorted? Where are the calculations out? Is it on the YTD reports for the ATO? You can try completing a $0 pay run to pull through the data and check if the YTD numbers are correcly reported.

Let me know how its going.

Cheers,

Theresa

MYOB Community Support

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Mark it as a SolutionHelpful? Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

November 2019

November 2019

Re: Super Calculations on MYOB AR Live Plus 2019.3

Hello,

Thanks for your input.

It's not the YTD figures, it's during the processing of Payroll. I put in the hours and allowances and the Super isn't calculating correctly in most cases. EG the base hourly might be 38 hours @ $32/hr = $1,216.00, plus 25% Casual loading plus fares which might make $1480, but the Super will self calculate at $53 on one payslip and $110 on another, with the actual correct amount of 9.5% Super of $140.60 only working every now and then (usually on employees whose card files I srtarted since the upgrade). We have about 60 employees at the moment and they all receive 6-10 different sorts of payroll categories so it;s a hassle. All the employees are set up the same and most in the same fund. Sometimes the super is higher, but usually lower.

I just calculate them all manually at the moment.

Don't get me started on the amount of time it takes for transactions to record, for windows to open, on the formatting errors with imported forms, on payslips not printing in batches so I have to do them one by one, on statements not emailing from the software, on the payslips printing out with the payroll categories all jumbled up (different to how they were entered) so they are hard to check, and on the extra subscription I had to purchase to hold 3 x company files for the pleasure of using it!

Still yet to set up STP, not looking forward to it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

November 2019

November 2019

Re: Super Calculations on MYOB AR Live Plus 2019.3

Hi @Shilolilo

Thank you very much for the additional information.

I'd like to clarify that super calculation in AccountRight isn't purely based on the payroll figures within that particular pay run, it rather checks the total applicable wage and total super recorded so far in the calender month, and increase/decrease the super amount in the next pay (within the same month), so the total super would be 9.5% of total applicable wage based on the current settings. I'd suggest checking out this Help article as it explains it in details: Checking and adjusting superannuation.

This means that if any manual super adjustment was made in that month, it will affect the next super calculation within that month. The manual adjustment could be made by manually editing the super figures within a pay run, or changing the figures in employee card > Payroll Details > Pay History.

The best way to verify whether super is being calculated correctly or not, is going to the Pay History screen, filter the pay history by month, then check if the total super amount is 9.5% of total applicable wage. This is assuming no further manual adjustments were made after the last pay run was recorded in that month. And pay runs are reported based on their payment date, not pay period. You can also record a dummy pay in a future month, where no pay runs were recorded, and the pay history in employee card has no monthly figures. The super amount should calculate based on the figures within that pay only.

Going back to your initial post, the super calculation is set to 9.5% of Gross Wages, LAHA is ticked to be exempt. This does mean that super will be 9.5% x (Gross wage - LAHA), this is correct. I'm not sure what you mean by 'I don't want it to deduct it, just not include it in Gross Wages.', as not including LAHA in Gross Wages means deducting LAHA from Gross. Then when you unticked LAHA from Exempt, AccountRight will then take into account of all the LAHA amounts recorded in the month, and adjust it accordingly. For example, 1 pay was recorded earlier in the month with LAHA being exempt, changing the setting now means in the 2nd pay run, super will need to be calculated on the total LAHA amount to date, which would be based on $504 x2.

I hope this clarifies it for you. I do suggest following the Help article linked to check if super calculation is incorrect in a new month, please feel free to let us know how you go.

Kind regards,

Clover

MYOB Community Support

Online Help| Forum Search|Download Page

Did my answer help?

Mark it as a SolutionHelpful? Leave a to tell others

Didn't find your answer here?

Related Posts

|

by

AL6

2 weeks ago

0

64

|

0

|

64

|

||

|

41

|

3082

|

|||

|

14

|

557

|

|||

|

8

|

497

|

|||

|

1

|

203

|