Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- AccountRight: Payroll

- >

- Re: Tracking Leave Accruals as Liabilities

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Tracking Leave Accruals as Liabilities

Some of the links and information provided in this thread may no longer be available or relevant.

If you have a question please start a new post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

January 2021

January 2021

Tracking Leave Accruals as Liabilities

Hi All,

I have been asked to set up our leave accuals as liabilities.

Reading the following link:

Is it necessary to change the following in red ????

- Go to the Payroll command centre and click Payroll Categories.

- In the Wages tab, click the zoom arrow beside the Holiday Pay wage category. The Wages Information window appears.

- If you report payroll information to the ATO through Single Touch Payroll, select the applicable ATO Reporting Category. Typically this will be the same ATO Reporting Category you've selected for your Base Hourly or Base Salary wage categories. Learn more about assigning ATO reporting categories for Single Touch Payroll reporting.

- Select the Override Employees' Wage Expense Account option.

- Click the drop-down arrow beside the Override Account field and select the appropriate account. If you choose a liability account, a warning will appear advising that the linked account should be an expense account. Disregard the warning. See our example below.

Rather can I just leave it in the wage expense account.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

January 2021

January 2021

Re: Tracking Leave Accruals as Liabilities

Hi @Jen65

If you're tracking leave accruals as liabilities, then this account needs to be changed to a liability account as per the steps in the help article as it will reduce the account balance when you pay the liability. If it's set to a wage expense account, paying the leave will not reduce the account balance.

Let us know if you have additional questions on this.

Kind regards,

Komal

MYOB Community Support

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Mark it as a SolutionHelpful? Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

January 2021

January 2021

Re: Tracking Leave Accruals as Liabilities

Thanks - question is this going to cause a problem with reconciling wages paid for the end of financial year reconciliation ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

January 2021

January 2021

Re: Tracking Leave Accruals as Liabilities

Hi @Jen65

Kind regards,

Komal

MYOB Community Support

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Mark it as a SolutionHelpful? Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

January 2021

January 2021

Re: Tracking Leave Accruals as Liabilities

thanks Komal

I dont know why this is confusing me so much I called myob to discuss but no one could help me.

Entering everything as mentioned on myob webiste is clear it really was just overriding the wage expense account that threw me.

Do you think it would be a problem if i had annual leave and long service leave as one amount or do i need to separate these ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

January 2021

January 2021

Re: Tracking Leave Accruals as Liabilities

Hi @Jen65

As has been indicated, overriding that wage expense account on the linked wage categories is recommended as it will reduce the balance of that liability account when that leave is paid out. As this does reflect what is happened in real life i.e. paying that leave out as reduced the liability of the business.

A real-world example would be to say my leave liability sits at $200. My employee is being paid $20 an hour for 8 hours of annual leave ($160). If I pay that out to the leave, my liability is reduced 160. When you have that override option set up it will automatically reduce that liability to be $40 after the pay. If it wasn't set up it would remain at $200 even though I have paid it out.

Now, in theory, you don't have to override that expense account and rely solely on journal entries to manage the leave liability. However, it's not the best practice as it doesn't accurately reflect that leave liability in real-time as you could have paid it out but not updated the leave liability account.

You also mentioned annual leave and long service leave is one amount. There is nothing stopping the user from setting it up like this or with multiple setups one for each leave type. It's solely how you wish to capture that information and report on it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

February 2021

February 2021

Re: Tracking Leave Accruals as Liabilities

@Steven_M wrote:Now, in theory, you don't have to override that expense account and rely solely on journal entries to manage the leave liability. However, it's not the best practice as it doesn't accurately reflect that leave liability in real-time as you could have paid it out but not updated the leave liability account.

I agree that overriding the expense account (and debiting instead the liability account) reflects the liability in real-time. But I think we are missing one more step to be done at EOY journals: that is to debit the expense account and credit the liability account with the total paid leave during the year . I have explained this on detail on my other comment, but please correct me if I am wrong. But if Im right, I think the MYOB procedure should be revised

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

February 2021 - last edited February 2021

February 2021 - last edited February 2021

Re: Tracking Leave Accruals as Liabilities

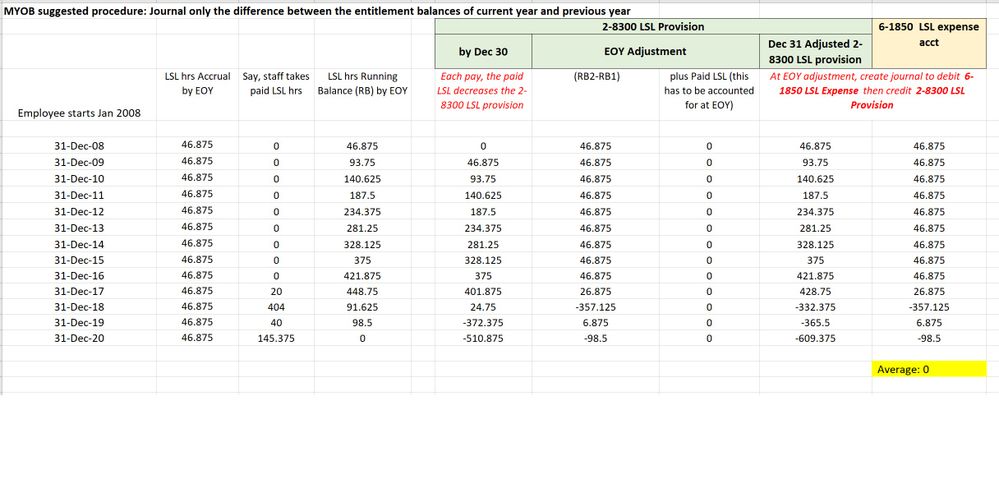

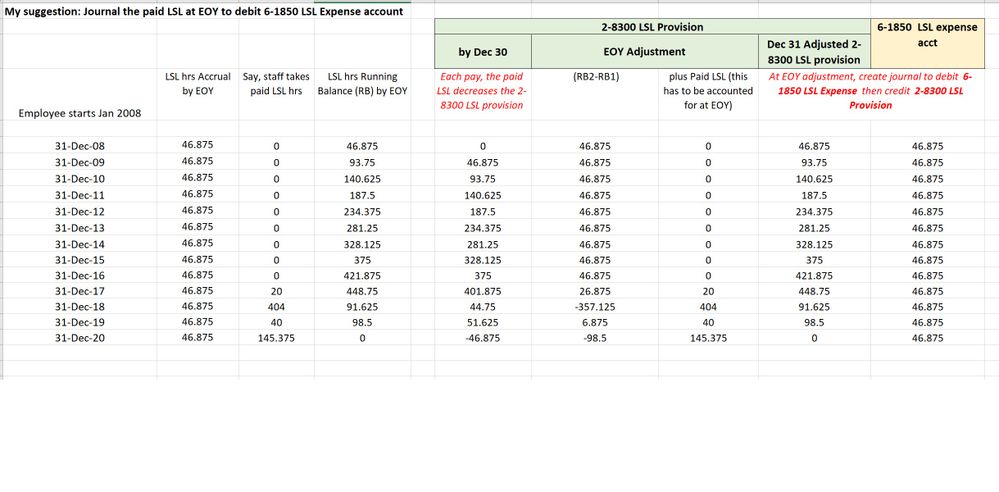

I cant find my previous post, so here it is again. There are 2 scenarios where the 2nd scenario is I journaled on EOY the paid LSL to debit the expense account and credit the liability account

(I work at school, so EOY is December. LSL accrual is 10weeks after 8years)

The 2nd scenario gives accurate expense and liability accounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

February 2021

February 2021

Re: Tracking Leave Accruals as Liabilities

Hi @Yane_Emma

If you don't override that employee expense account on the linked wage category to be the liability account then a journal entry would be required to manually create the journals when the employee takes leave. This journal entry can be completed when the leave is taken or when completed at another time such as the end of the month or end of the payroll year. Typically, this journal entry would be crediting the expense account (reducing it) and debiting the liability account (reducing it).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

March 2021

March 2021

Re: Tracking Leave Accruals as Liabilities

Im sorry i really need help again on this one @Steven M

Now on my second month when i run the entitlement balance and then do the journal entry for the change in figures my liability account balance is showing a lower amount than the expense account.

Yet the expense account reconciles with the leave entitlements balance, amount for the end of the month and the liability account is a lower amount???

Didn't find your answer here?

Related Posts

|

1

|

376

|

|||

|

26

|

1064

|

|||

|

21

|

1596

|

|||

|

1

|

682

|

|||

|

14

|

1338

|