Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- AccountRight: Payroll

- >

- how to set up a salaried employee paid monthly for...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

how to set up a salaried employee paid monthly for annual leave entitlement in account right plus v 19

Some of the links and information provided in this thread may no longer be available or relevant.

If you have a question please start a new post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

February 2019

February 2019

how to set up a salaried employee paid monthly for annual leave entitlement in account right plus v 19

Good morning Graeme

I am in the forum and read your postings. I am having difficulty setting up an employee on salary to receive extra month salary for annual leave. So payments for whole year will be 13 months.

I need a new category, new entitlement and new account no. linked just for this 1 salaried employee

Would I be able to send you my myob file so you can set up please. It is only for this 1 employee. I know how to do this for hourly employees but confused on how to do the salaried.

If you are too busy, maybe you know of someone who could set this up for me.

Thanks

Regards

Linda Jones

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

February 2019

February 2019

Re: how to set up a salaried employee paid monthly for annual leave entitlement in account right plus v 19

graeme probably won't see this unless you tag him, I'm assuming this is for @GDay53 (the only graeme I see on the payroll boards)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

February 2019 - last edited February 2019

February 2019 - last edited February 2019

Re: how to set up a salaried employee paid monthly for annual leave entitlement in account right plus v 19

Welcome to the MYOB Community Forum, I hope you find plenty of useful information.

Linda I found the post I was talking to about and this is it;

If you have not already done so you need to setup seperate Wage and Entitlement categories for Salary staff to Hourly staff.

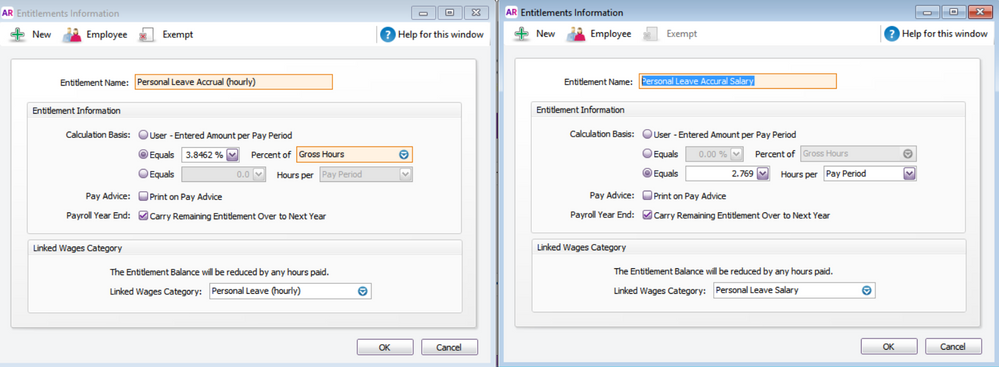

Normally for any employee on Base Hourly you would use the Wage Category Holiday Leave and Personal Leave, while those on Salary you would create new Wage Categories Holiday Leave Salary and Personal Leave Salary, similar to theses;

You would also normally use the % calculation method in the Entitlements of those employees on Base Hourly, but you would need to create new hourly based Entitlements for the Salary staff like these;

Note the linked wages categories.

The 7.6923% is based on 4 weeks leave a year and the 3.8462% on 10 days /year. These % does not change even if the work hours change - the % is the same for 40 hrs weeks, 38hr weeks, 36hr weeks and so on.

The hours used in the Salary entitlements are based on a 38hr week with fortnighly payments so you would need to change these to suit your situation. e.g. if 38 hr and weeklypays then the amounts would be 2.769 for holiday and1.3845 for Personal leave.

Note the screen shots are based on AR2018.4 so a slightly different to V19 you are using.

Also if you are paying monthly then the Holiday hourly accrual amount will be 7.6923% of the nominal monthly hours and the Personal leave accrual will be 3.8462% of the same nominal monthly hours.

You also need to make sure the of correct Excempt wage categories for the Entitlements. To do this you MUST have the calculation basis set to %. So for the Salary Entitlements start with them as % set the excemptions then change the calculation method to hours.

Also don't forget that you need to make sure that the correct Wage and Entitlement Categories are ticked off on each employee's card.

You mentioned that you want to keep this employees ages eperate from all the others to do this create a new Account in beside your existing Wages & Salaries account and on the employees card under payroll Details > Wages, make sure the wages expenses account is this new account.

You should also have a read of the Support Notes on Adjusting Leave Entitlements and Leave and Entitlements.

Graeme Day

Registered BAS Agent #24745540

Gralord Enterprises Pty Ltd

Mobile: 0402 841 627

graemeday@optusnet.com.au

MYOB Certified Consultant

MYOB Diamond Partner

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

February 2019

February 2019

Re: how to set up a salaried employee paid monthly for annual leave entitlement in account right plus v 19

Thanks so much Graeme. Sorry for my vague question. I already have the salaried employee set up in my myob receiving monthly salary. I have no problems here as I can capture all salary pay, payg. The problem started when management decided to give this person an extra month for annual leave i.e. 13 months to be paid in total.

Please help me set up only this annual leave entitlement asthis salaried employee has already been set up as a salaried staff.

I would want to create another code for holiday so I can capture which is 5-6700

Account code for base salary - 5-6100 existing one for monthly salary

Account code to be created for holiday pay 5-6700

Annual salary is $21600

monthly salary is $1800

Hours in month - 164.667 hours each month

hoursly rate would be - $10.9311

As employee will be getting 164.667 hours a/l each year, accrual each month is 13.722 hrs per month\

Please help me set up this category for annual leave salary. Everytime the employee clears a/l account no. is 5-6700 (different from his monthly pay code of 5-6100 so I can capture a/l separately). How do I set up entitlement so everytime employee clears annual leave, the balance is reduced.

It will be highly appreciated if screen shots be shown or better still maybe the clearwater free sample file could be worked on and sent to me. My email is linda.jones018@gmail.com. This will be clearer to me. I am totally confused. I have read a lot of postings but getting more confused more than ever. So if a sample company file could be used, that will be most appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

February 2019

February 2019

Re: how to set up a salaried employee paid monthly for annual leave entitlement in account right plus v 19

Hi Graeme

thanks for that. I followed your instructions to the letter but found another issue

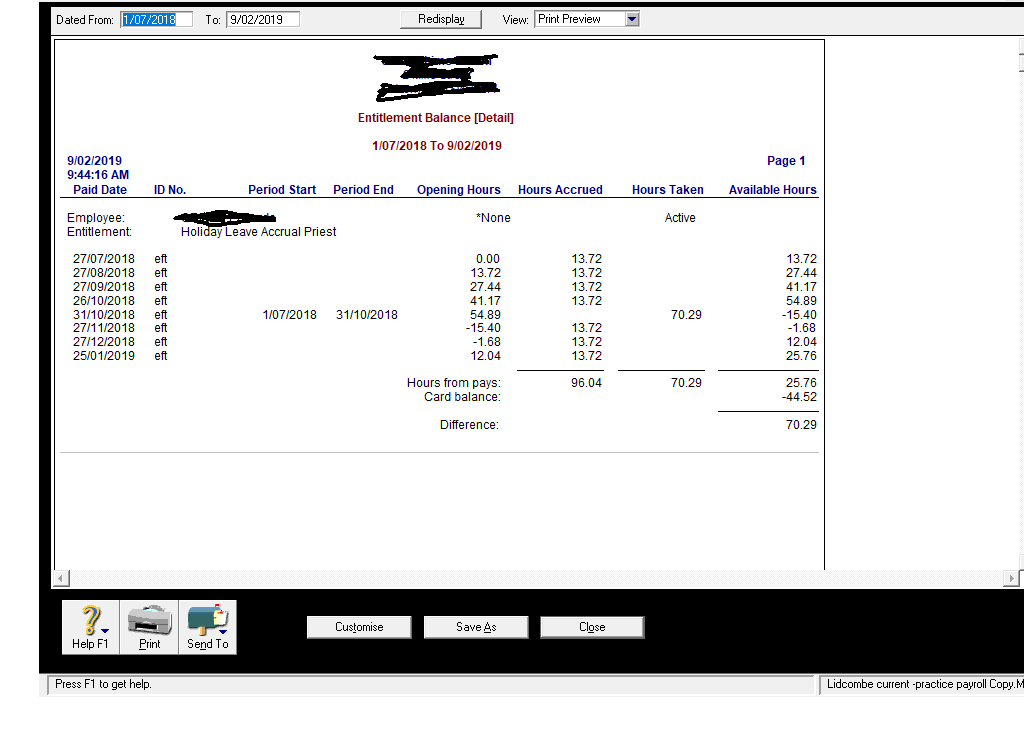

I created category Holiday Pay Priest. I have created new account no. for holiday pay. My problem is why the entitlement details do not match card balance. The entitlement details are correct. But the card balance is out by 70.29 hours which is the difference. It appears like the card balance deducted this twice instead of only one. I checked my entries and ensured only entered once the 70.29 hours annual leave taken. Why did the card balance double up? Please see attached screen shot.

Also this salaried employees accrues 13.722 hours per month for annual leave. The total hours a year is 1976 hours so each month is 164.667 hours. As this employees is entitled to 164.667 hours a year, the monthly accural will be 13.722.

Would you please be so kind to have a look at my file? I am using Account Right Plus v. 19 . We are a small church and with only 3 hoursly employees and 1 salaried employee so we did not bother upgrading software.

Also is there a way of manually stopping the accrual for the month. Say I already paid the monthly salary and the employee accrued the 13.722 hours. Now if I want to pay an expense item, I noticed that again the 13.722 hours were accrued. So what I did was change the accrual to 0 and then paid the epense. Then I changed it back for next month's pay

Not a big file so if you dont mind, please have a look at this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

February 2019

February 2019

Re: how to set up a salaried employee paid monthly for annual leave entitlement in account right plus v 19

Hi @lindajones

When you go to Payroll>>Payroll Categories>>Entitlements>>Select the Entitlement category - what do you have selected in the Linked Wages category? While you can have multiple wage categories selected, the recommendation is to have one wage category selected, multiple wage categories can create reporting errors similar to what you are experiencing.

Along with that as it is the card balance that is showing incorrectly, I would be reviewing the value that you do have in the Pay History of that employee for that entitlement. The Pay History for an entitlement can be seen via the employee's card>>Payroll details>>Pay History (left-hand side). Ideally, this will be the total amount accrued for that employee over the period of time, if that value is a different value doing so would create out of balances.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

February 2019

February 2019

Re: how to set up a salaried employee paid monthly for annual leave entitlement in account right plus v 19

thanks Steven.

I was able to set up this salaried employee annual leave and all accruals. This is what I have done:

1) created a payroll category called Holiday Leave Accrual Salaried. My hourly employees accrue at 7.69% of gross. As my salaried is going to be a fixed hours every pay, I worked out that this salaried employee should accrue 13 hours every month for 12 months. Everything went well, my card balance, payroll history and entitlement details and summary all tally. All my hourly employees' basic wage and holiday pay go into one account no. The salaried employees goes into another account which means all his basic salary and annual leave are into the one account.

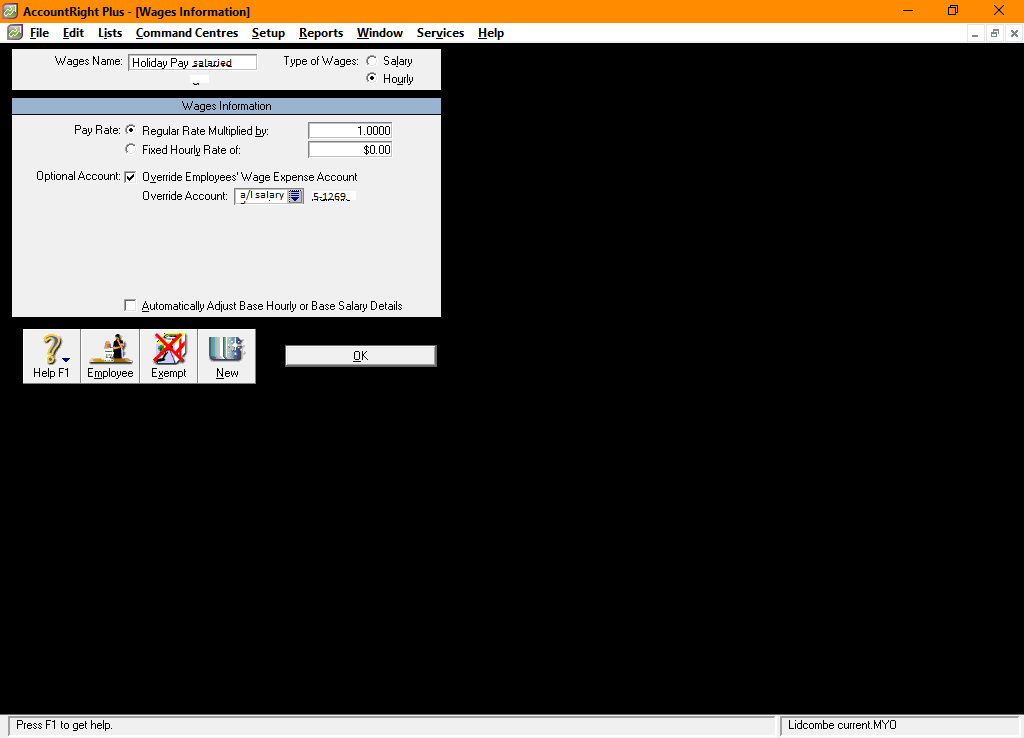

Management, however wanted me to create separate account for annual leave alone for this salaried employee. I tried creating a payroll category for this salaried employee's annual leave and called it Holiday Pay Salaried. The salaried employee has just cleared 30 hours. I then processed this as annual leave on its own deleting accrual, and super as the accruals are only for the basic salary. After I've done this, these 30 hours instead of being deducted was added on to the total hours entitlement. Being incorrent, I deleted this entry and just processed the holiday pay as normal without the new account no. 5-1269. All went well and all balanced. However, annual leave and basic wage were lumped together in the one account no..

Management was hoping though I could capture annual leave by creating a new account 5-1269 and using this when clearing annual leave. In this way the general ledger will record this separately. Is this possible? I was able to create the entitlement called Holiday Leave Accrual but could not create another account no for this so all annual leave gets debited there and not to the main account. Please enlighten me Attach is my screen shot.

thanks a lot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

February 2019

February 2019

Re: how to set up a salaried employee paid monthly for annual leave entitlement in account right plus v 19

Hi @lindajones

By default, AccountRight doesn't track the dollar value associated with leave entitlements. If this is required our AccountRight v19 Support Note: Tracking leave accruals as liabilities goes through that process. In terms of what I can see from that Wages Information window, you may wish to change the Wage Expense Account of that linked wages category to be a liability account, however, I have also seen it set to be a cost of sales account.

You also mentioned that when processing leave it added a series of hours to the employee instead of deducting them without seeing how that transaction was processed it can make it difficult to judge what was occurring. In saying that, it would generally be a combination of instead of entering a positive value against the linked wage category when processing the pay a negative value was entered OR you have added a negative to the entitlement accrual value.

Ideally, when processing a pay that does include the taking of leave, you would enter a positive amount of hours against the Linked Wage Category (i.e. in this case Holiday Pay Salaried ).

Didn't find your answer here?

Related Posts

|

1

|

362

|

|||

|

9

|

576

|

|||

|

26

|

1057

|

|||

|

4

|

414

|

|||

|

21

|

1551

|