Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- MYOB Business

- >

- MYOB Business: Banking

- >

- Rental Income and Maintenance Spending

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Rental Income and Maintenance Spending

Some of the links and information provided in this thread may no longer be available or relevant.

If you have a question please start a new post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

October 2021

October 2021

Rental Income and Maintenance Spending

Our Church has a rental property and each month we get a statement from the Estate agent showing what rent has been paid and deductions for any repairs Prior to MYOB changing its format it was easy all I did was change the bank amount and if there were deductions which had been entered on the statement I put in the relevant code together with the amount and GST. The amounts balanced. Now that MYOB has changed its format I am cannot enter the Deductions together with GST. My question is how do I show what repairs have been done and claim the GST, when there is no entry from the Bank Feed

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

October 2021

October 2021

Re: Rental Income and Maintenance Spending

Hi @stpaddy9001

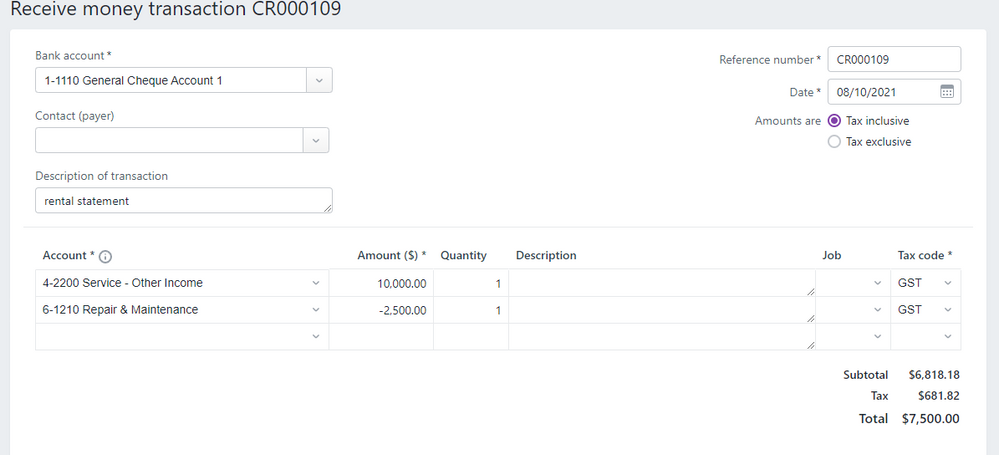

Apologies for the delay in replying. From a software perspective you could record either a Receive Money or Sales invoice and invoice payment. Allocate the total rental income to the income account and allocate the deductions as a negative amount. You can then match the transaction in bank feeds.

I would recommend checking with your accountant to make sure this suits your needs.

Please let me know if you need further help.

If my response has answered your enquiry please click "Accept as Solution" to assist other users find this information.

Cheers,

Tracey

Previously @bungy15

MYOB Community Support

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Mark it as a SolutionHelpful? Leave a to tell others