Partner Zone

Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

Share your ideas for improving MYOB Business. Vote on ideas and discuss them with the MYOB product development team.

Last Changed:

October 2014

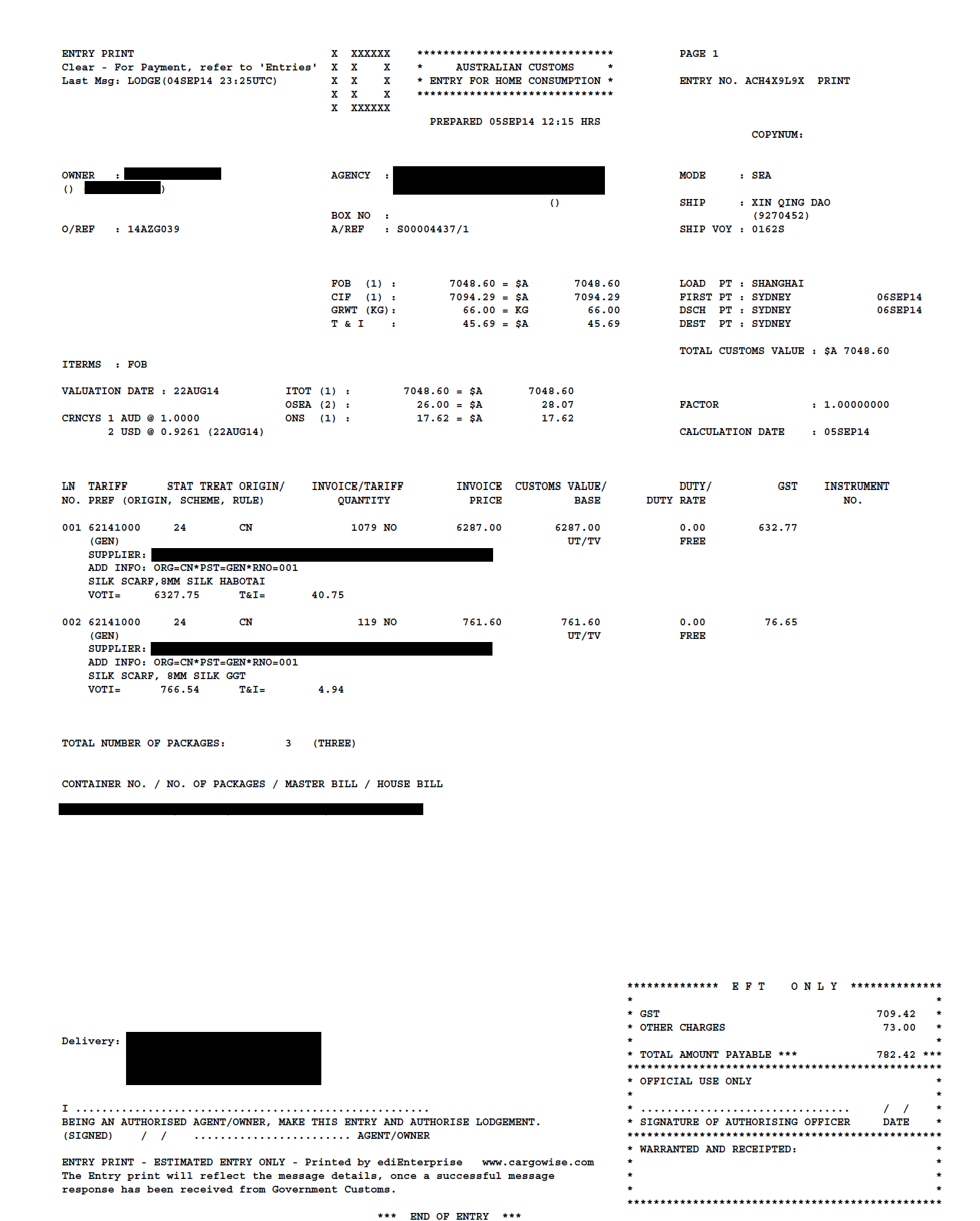

Thanks for the great suggestion. It is true that deferred GST on overseas purchases can't be easily added to a purchase and requires you to create two lines for the full amount (a positive line including with GST and a negative line without).

It would certainly be simpler if a 'pure GST' or 'import GST' tax code could be created so that the software can handle importation GST more easily. Anyone who would like to see this, please cast your vote here.

10 Comments