Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- MYOB Business

- >

- MYOB Business: Payroll & MYOB Team

- >

- Re: All purpose allowance

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

STP 2 All purpose allowances

Some of the links and information provided in this thread may no longer be available or relevant.

If you have a question please start a new post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

December 2022

December 2022

Re: All purpose allowance

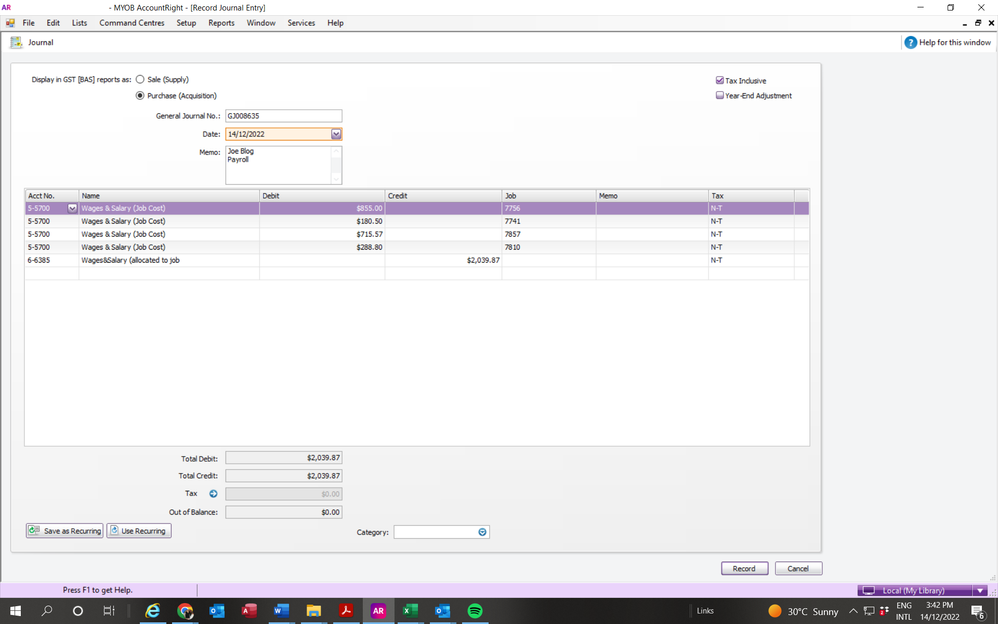

@YasminG1 I used to allocate each category to a job number, it became too much. So my simple way now - with assistance of spreadsheets - I enter a journal with the total value against each job for each employee. ie: Each journal is for one employee where I allocate values against jobs - debit cost of sale and then credit the total value of the journal to an expense account (you don't allocate to a job number).

By debiting cost of sale and crediting expense, there's no effect on the P&L, but the cost of sale gets allocated to the job.

It works for us, we don't have to know the categories, just the cost for each job.

Would this work for you?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

December 2022

December 2022

Re: All purpose allowance

Hi Yasmine,

Thanks for your reply. My clients need to know the employees for the jobs. I use MYOB Time Sheets which is fantastic for allocating jobs. Either way, having to split the All Purpose Allowance is going to be an extremely time consuming, costly and very frustrating task.

We're still waiting to hear from MYOB i.e. to request a defferal to 31st March 2023 and I'm still hoping the ATO re-think this change 🙏

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

December 2022

December 2022

Re: All purpose allowance

MYOB have you done anything about requesting a deferral from the ATO at least till the end of March 2023? If not, have you given any thought as to HOW we are to handle the All Purpose Allowances....GRRR

I'm hoping the ATO will come to their senses to squash the All Purpose Allowances to be split and leave it as it is!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

December 2022 - last edited December 2022

December 2022 - last edited December 2022

Re: All purpose allowance

Hi @carmen

We do have a deferral in place for our MYOB Essentials users still on the Orginal platform - this is in place until the end of March 2023. For other users we do recommend transitioning to Single Touch Payroll v2 by 1st January 2023.

As mentioned, previously on this thread, The all purpose allowance is a very specialised part of the Single Touch Payroll v2 process and should be set up with the assistance of your accounting/payroll advisor to ensure that you meet your reporting requirements. We are aware that the current setup of an all purpose allowance is complex, we are looking into solutions to try and simplify this process for our customers next year.

You may wish to take a look at FAQ> Can I set up an "all-purpose allowance" on Help Article: Allowances for some more information. Alternatively, some users on this thread have offered some advice on the topic and how they are handling it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

December 2022

December 2022

Re: All purpose allowance

Hi Steven,

Thanks for your reply. I am aware that MYOB have a deferral for Essentials until the end of March 2023 BUT MYOB needs to request from the ATO and deferral for AccountRight also at least until the end of March 2023 because the software is not compliant to handle the All Purpose Allowances!!! Why shoudl there be so much pressure put on us bookkeepers and businessess when it is a software issue. I have contacted the ATO and numerous Associations regarding this topic and they all say it is a software issue. The changes for the All Purpose Allowances is horendous. FYI: I had previously checked FAQ> Can I set up an "all-purpose allowance" on Help Article: Allowances for some more information. This only confirms what we already know and that is MYOB is not set up to handle "all purpose allowances"

Can MYOB please give us some advice as to how to go about handling these changes apart from setting up three new Payroll Categories what about Overtime, A/L, S/L etc etc etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

December 2022

December 2022

Re: All purpose allowance

Hi Carmen

Im not sure how many allowances you are paying?. We pay all purpose allowance and have set it up as follows have added a file with what I have done incase it helps. Have to help if you need any.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

December 2022

December 2022

Re: All purpose allowance

Hi Leisa,

Thanks for your reply. I can see that you have split up all the payroll categories for the "All Purpose Allowances" and you've also set up seperate overtime categories for the all purpose allowances. The ATO have stipulated they only want ONE Overtime payroll category. Am I able to contact you to discuss how you're handling these changes. My other concern is not just the payroll categories but allocating the Jobs!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

December 2022

December 2022

Re: All purpose allowance

Hi Carmen you can contact me if you like. If you send me your email address ill email you my contact no.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

December 2022

December 2022

Re: All purpose allowance

Thanks Lisa. carmen@allfiguredout.net.au

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

December 2022

December 2022

Re: All purpose allowance

Hi @carmen

You wrote "The ATO have stipulated they only want ONE Overtime payroll category. "

Just to clarify, you can have 20 payroll categories for overtime if you like/need, you simply assign then all to the one Overtime STP Field. The ATO generally don't concern themselves with payroll categories.

NB I agree MYOB does not handle the use of an All Purpose Allowance well at all, esp if using Jobs.

Regards

Gavin

Didn't find your answer here?

Related Posts

|

by

15

1251

|

15

|

1251

|

||

|

7

|

1065

|

|||

|

3

|

1180

|

|||

|

1

|

1069

|

|||

|

13

|

2096

|