Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- New Zealand

- >

- New Zealand GST

- >

- Re: GST on multiple items

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

GST on multiple items

Some of the links and information provided in this thread may no longer be available or relevant.

If you have a question please start a new post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

August 2018

August 2018

GST on multiple items

Hi. I've just started my first business so new to both MYOB and GST so just trying to work my way through it.

I have a query on an invoice I created (in Essentials)...

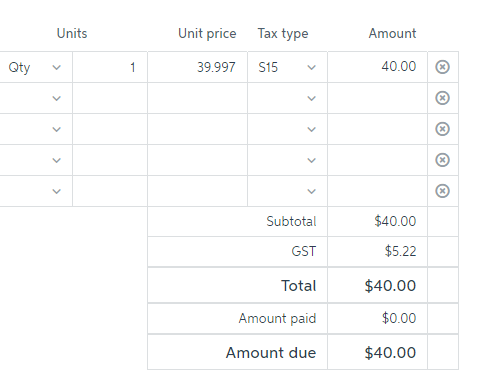

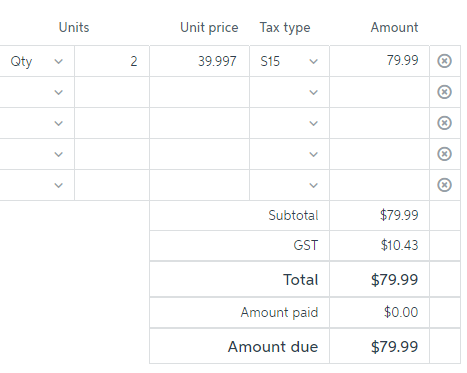

I have items I'm selling for a round figure ($40), and if I add 1 item to the invoice it tallies to $40 correctly, but if I change quantity eg to 2, the GST isnt then tallying to the round number ie it'll show the total as $79.99 not $80. What I'd like the customer to see is the correct rounded price of $80 not $79.99.

Can you please point me in the direction of what I might have not set or set incorrectly? If I separate the items onto 2 lines, it'll total correctly to $80, but that's more tedious to generate invoices.

Thanks ![]()

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

August 2018

August 2018

Re: GST on multiple items

Hi @Beks

Welcome to the MYOB Community Forum, I hope you find it a wealth of knowledge

Just testing within my MYOB Essentials account I have been unable to replicate what you are describing:

So we can get a better understanding of what the situation can you provide a screenshot of the invoice (similar to that listed above).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

August 2018

August 2018

Re: GST on multiple items

Hi Steven,

Showing Qty 1 and 2...

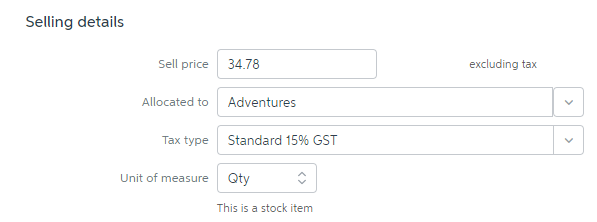

I could only see when adding items to do it excluding tax - I don't seem to have an option which does it including... so I'm not getting it to a round figure on the unit price like in your example.

Thanks ![]()

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

August 2018

August 2018

Re: GST on multiple items

Hi @Beks

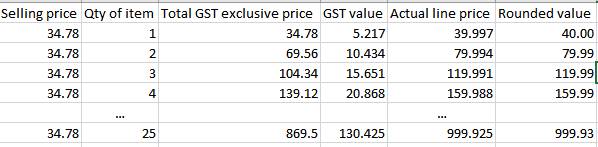

The difference is caused by the rounding of values for items.

Firstly, MYOB Essentials only allows the user to set up an item with 2 decimal places as the unit cost. This does mean that there will be some rounding of values to determine the total amount.

For example, if you look at the below table it outlines what is occurring. As the actual line price is being rounded to 2 decimal places it is encountering a different value that you would expect to see. This is due to the fact that the actual selling price of the item is $39.997 (not $40.00).

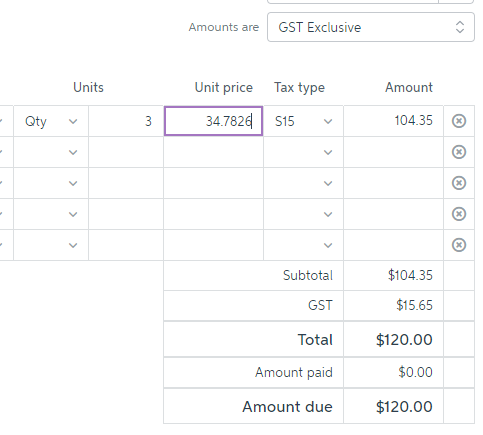

In saying that on the actual Create Invoice window you can have up to 4 decimal places as the unit price. So, in your case, if you wanted a more accurate total my recommendation would be to enter a GST Exclusive invoice with 4 decimal places with the unit price (being manually entered*) as 34.7826

Note: That this may change the method of entry for the invoice and how those invoices appear on the printed/email copy

*Would need to be entered manually rather than get it from the selling price of the item, as the selling price of the item can be set to be 2 decimal place but the unit price allows for 4 decimal places on the invoice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

August 2018

August 2018

Re: GST on multiple items

Thank you so much! That worked ![]()

Appreciate the help ![]()

Didn't find your answer here?

Related Posts

|

by

BareBeauty

2 weeks ago

8

161

|

8

|

161

|

||

|

3

|

410

|

|||

|

4

|

489

|

|||

|

1

|

399

|

|||

|

4

|

703

|