Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- New Zealand

- >

- New Zealand Payroll

- >

- Kiwisaver included in Salary Remuneration

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Kiwisaver included in Salary Remuneration

Some of the links and information provided in this thread may no longer be available or relevant.

If you have a question please start a new post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June 2021

June 2021

Kiwisaver included in Salary Remuneration

Hi

I just want to clarify an employee who has an hourly rate of $38 p/hr but in their IEA it is written that kiwisaver is included in their remuneration package.

Can you please confirm how to set this up in MYOB Payroll.

I have set up the hourly rate at $38 p/hr and set up and I have entered a Pay at 57.5 hrs, but I don't understand the payslip details, refer to attachement.

Could you please clarify the Salary Sacrifice showing at 2.83% at $61.84, and how is the calculation of the Net Employer Superannuation Contribution of $85.47 made up of.

When I look at the Payroll Summary Report it shows the Employer Super amount $127.38, I can't match it to what is on the Payslip.

Can you please confirm if what I have entered in is correct, and how I can track Kiwisaver to both reports and explain that the employee is actually paying the kiwisaver employer portin in the Salary Sacrifice.

Thank you.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June 2021

June 2021

Re: Kiwisaver included in Salary Remuneration

Hi @HCL

When processing a pay within MYOB Payroll, you can select the Super button and it will give you more of an insight into what is occurring with the superannuation for that particular pay.

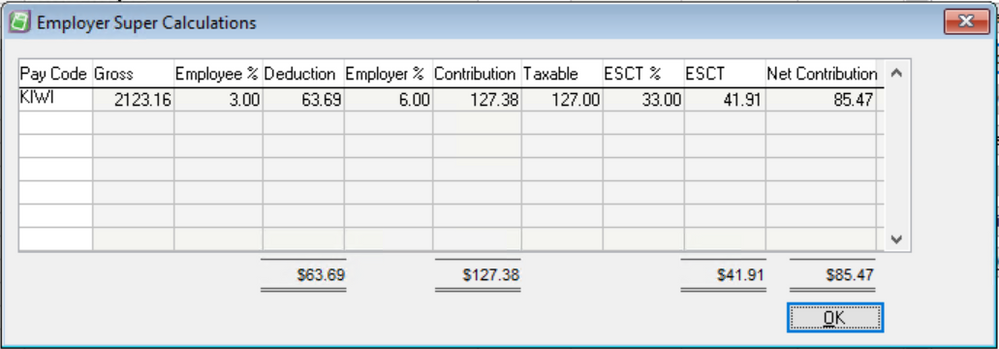

In your case, the following window would have likely been shown if you selected that option:

To go into specifics, the $127.38 on the Payroll Summary Report is the Gross multiplied by the employee contribution rate (Employer contribution (funded by the employer) and Employer contribution (funded by salary sacrifice)). Or in other words, 2123.16 x 6% = 127.38.

In terms of the 2.83%, the employer contribution (funded by salary sacrifice) entered value includes an additional component that is not included when the pay is processed. From memory, it's the ACC Earner Levy value that is removed from that percentage to give you a slightly lower percentage when processing the pay.

Generally speaking, the employer contribution (funded by salary sacrifice) option is not used within the softwre. Typically, if you are needing the Kiwisaver included in the salary you would enter the rate excluding that superannuation amount. This way you have the rate and super is calculated on top of that.

Didn't find your answer here?

Related Posts

|

by

BareBeauty

2 weeks ago

8

144

|

8

|

144

|

||

|

3

|

1172

|

|||

|

by

2

554

|

2

|

554

|

||

|

by

4

1889

|

4

|

1889

|

||

|

by

5

1509

|

5

|

1509

|