Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- The AccountRight Blog

- >

- AccountRight 2018.2.1 now available

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

AccountRight 2018.2.1 now available

This release is for Australian businesses using AccountRight Plus or Premier only.

If you’re in New Zealand, or use AccountRight Standard or Basics, you don’t need to install this update - 2018.2 is the latest version for you.

New PAYG tax tables apply from 1 July 2018. Install this update to ensure your business stays compliant.

What’s changed?

Tax table changes

The top threshold of the 32.5% individual income tax bracket will rise from $87,000 to $90,000

The top threshold of the 32.5% Working holiday makers tax bracket will rise from $87,000 to $90,000

A new lower minimum repayment rate and threshold applies for HELP debts

A new tax offset called the Low And Middle Income Tax Offset (LAMITO) applies from July 1. People who qualifiy for LAMITO will recieve it as a refund with their tax return at the end of the new financial year, not as a change they'll see in their regular pay.

New Payrun Summary Details report

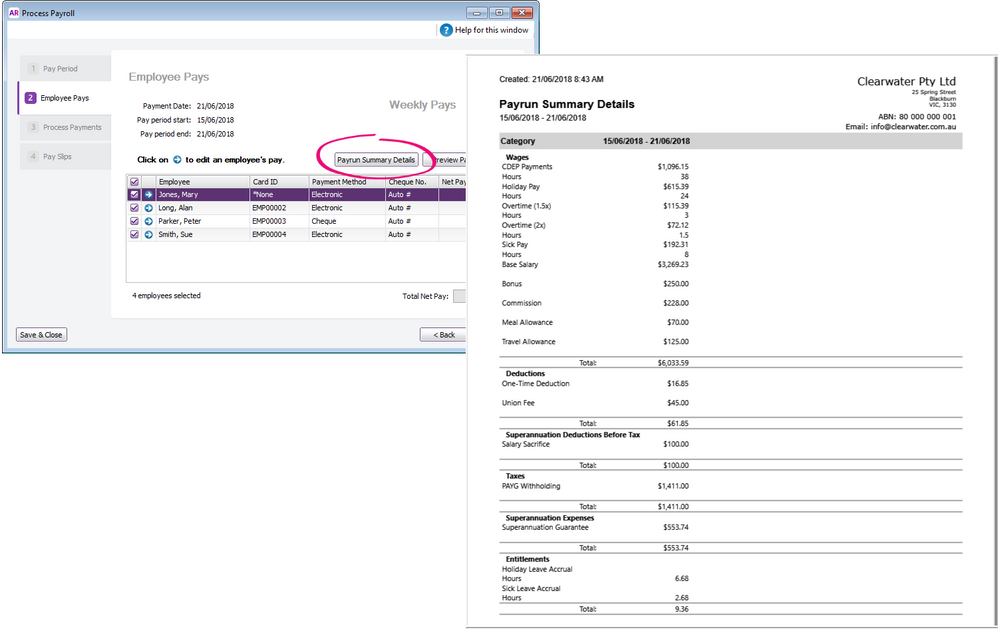

We’ve added a new report that lets you preview your pay run data before you record it and send it to the ATO (through STP). The Payrun Summary Details report gives you a more detailed view of the information you’re sending to the ATO, including each payroll category and the hours associated with it, and the total amounts for the current pay run.

You can generate the report during a pay run by going to the Process Payroll window > Employee Pays tab, and clicking Payrun Summary Details.

Other updates and improvements

- Improved: (AccountRight Server Edition only) We’ve added help for a ‘Server connection lost’ error.

- Fixed: We fixed an error that occurred for payroll categories, which prevented you from changing the STP category in files that were migrated from V19.

What do I need to do now?

Complete these steps before your first pay run in July 2018:

-

Install the 2018.2.1 update when you are notified in AccountRight.

- Prepare your payment summaries for your employees and close your 2018 payroll year.

- Once you've closed your 2018 payroll year, go to the Setup menu and choose Load Payroll Tax Tables.

- Click Load Tax Tables.

- If you have more than one company file, repeat these steps in each file.

To check that the tax tables have loaded successfully, open your company file, go to the Setup menu and choose General Payroll Information. The tax table revision date needs to be 01/07/2018.

|

Need help preparing payment summaries?

Our EOFY videos are just what you need.

We’ll also have a team of EOFY experts ready to answer your questions at selected times during June and July on Live Chat.

|

How to update

If you’re using AccountRight Plus or Premier in Australia, you'll be prompted to update when you open your company file over the next few days, or you can download the AccountRight PC Edition now (subscription required).

Installation tips

- When installation is complete, you won’t see a confirmation message. You can restart AccountRight immediately after installing the update.

- You won’t see a new desktop icon for the 2018.2.1 release. You can keep using the AccountRight 2018.2 icon to open AccountRight.

- Your company file won’t need upgrading, which means computers using 2018.2 or 2018.2.1 can open your file (but you should still install this update on all computers).

- If you already have Server Edition 2018.2, you will be notified that an update is available, however you can’t install the update directly from AccountRight’s notification window. You’ll need to:

- Uninstall your existing 2018.2 release from the server.

- Download the full 2018.2.1 Server Edition installer (subscription required)

- Install 2018.2.1 on the server.

- If you already have PC Edition 2018.2 and you choose to download the full 2018.2.1 PC installer from the my.MYOB website, you will need to uninstall your existing 2018.2 software before you can install the new version. To avoid having to do this, download the “update” or “patch” installer instead (look for a .msp file), or update when prompted in your AccountRight software.

-

If you need the MSI installer (for example you have terminal server or roaming profile network setup), download it here (subscription required)

- If you have issues updating, see our troubleshooting guide.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.