Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- AccountRight: Payroll

- >

- Pay Processing FAQs with Single Touch Payroll (STP...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Pay Processing FAQs with Single Touch Payroll (STP)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June 2018 - last edited May 2019

June 2018 - last edited May 2019

Pay Processing FAQs with Single Touch Payroll (STP)

Hi Everyone,

As we have released STP and have had a few months to get to know the new processes, we have had a lot of feedback and questions with how to process the Payroll now that there is STP reporting in the beginning that we have answered for new members below.

Before reading on, these questions are answered on the assumption that you have already set up STP. If you're still yet to set this up, feel free to check out this great Post for the details: Single Touch Payroll (STP) - Setup FAQs

Have a question that's not here? We'd be happy to help answer it! Just Start a Post and ask away.

The FAQ's:

The MYOB implementation of STP will send your current Pay Period information as well as your Year-to-Date information to the ATO. When you declare your first Pay Run with STP, this will send the Pay History of the Employee's along with it.

If you have terminated an Employee between your pay runs before signing on to STP, you will need to temporarily reinstate that employee and process a $0 (void) paycheque for the same Pay Period & Date as their Termination Pay then re-enter the Terminatation details into the Card.

Do note that current the ATO Business Portal does not show the YTD values and only Per Pay Period values. This is something the ATO are aware of in order to deliver full view of your STP reports. Though your employees can see the YTD values when they sign into their myGov account.

With every pay you declare, you send the updated YTD amounts to the ATO. With this in mind, if you have made a mistake, just correct like you have always done and when it's correct, the next time you run a Pay and Declare it the ATO will know to use the new YTD information that you've corrected.

Have some extra questions on this? Check out our post: Correcting mistakes with Single Touch Payroll

There is now only 1 extra step involved, and that's declaring your Payroll Event to the ATO directly after Recording the Pay.

So the steps would be:

1. Go to: Payroll > Process Payroll

2. Select your period & Employees as needed, then click Next.

3. Edit/Review your Employee's Pays and once you're happy just click Record.

4. Once you confirm the amounts to be recorded, you'll be asked to Declare the Pay Information is correct.

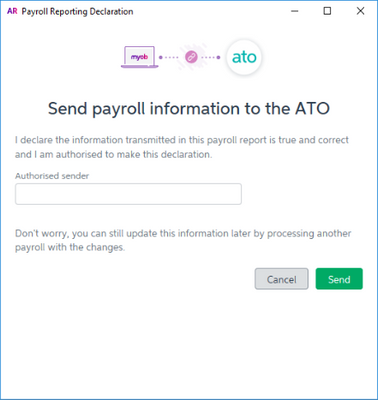

The declaration screen looks like this:

5. Enter the Sender's name (The Payroll Officer or Authorised agent to confirm details) and click Send

Then you're done! The information is sent to the ATO and all that's left is to actually pay the employees. Just as shown in this support note: Process cash, cheque and electronic pays

You can see your Pay Event by going to: Payroll > Payroll Reporting > Payroll Reporting Centre. Check out this support note: View payroll reports for Single Touch Payroll

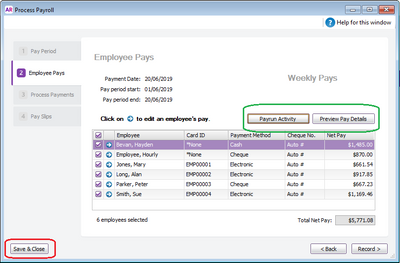

The software has you covered, just produce Payroll Verification report by click Preview Pay Details and click Save & Close, you can then send this report to your superiors to approve.

There are 2 reports in this window:

- Preview Pay Details (Payroll Verification) - Views the details of each pay before they are recorded.

- Payrun Activity - Designed to check the Pay Period values being sent to the ATO

Once you get that approval, just go back to Process Payroll and continue to Record and Declare to the ATO.

Once you have declared the Pay Run, it should begin uploading these details to our server to begin sending this to the ATO for acceptance. You can view the report in your Payroll Reporting Centre, just follow this support note: View payroll reports for Single Touch Payroll

There could be a few reasons why you can't declare right now, but you can still record your Payroll without Declaring and then just declare it later.

After your pay is processed, your pay will be waiting to be sent to the ATO. We just need to go to the Payroll Reporting Centre and send it. Just follow this support note: Send Single Touch Payroll reports after processing payroll

Yes, this is sending the data to the ATO to have them accept the data. This can take up to 72 hours to process during Peak Periods.

For information on the different status's in the Payroll Reporting Centre, see our support note: View payroll reports for Single Touch Payroll

Cheers,

Hayden

MYOB Product Team

Currently Working On:

Supplier Feeds | E-invoicing

In Tray

Previously Worked On:

MYOB Capture App | MYOB Invoices app

MYOB Support (2015-2019)

Didn't find your answer here?

Related Posts

|

2

|

258

|

|||

|

7

|

748

|

|||

|

1

|

591

|

|||

|

0

|

272

|

|||

|

12

|

860

|