Fran_29

2 years agoContributing Cover User

Solved

STP2

Hi,

I managed to update to STP Phase 2, but when I sent an update event, I received a message with" Accepted with errors", but it says the good news that it has been accepted by the ATO.

It says it needs to fix before the next pay run. Cessation Reason code must be provided.

I had a terminated employee -Lump sum A for unused annual leave.

Could you please help and advise? is it something that I have missed? I know the code is T, but I don't know where to put the code. Please advise. Hope to hear from you soon. Thank you.

Kind Regards

Fran

Hi Fran_29

From here

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in using your MYOB account details (email address and password).

- Click the Employee terminations tab.

- Choose the applicable Payroll year and click Add Termination.

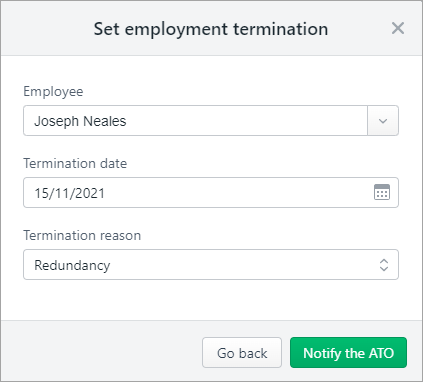

- Enter the termination details and click Notify the ATO.

Regards

Gavin