Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- AccountRight: Payroll

- >

- Update Event through STP for Tax File Number

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Update Event through STP for Tax File Number

Some of the links and information provided in this thread may no longer be available or relevant.

If you have a question please start a new post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

August 2020

August 2020

Update Event through STP for Tax File Number

Hi,

I processed one pay for an employee, who's employment ended quickly. I had his tax details, and expected the return of the TFN declaration form. He didn't return the form, so now I need to update the pay through STP with the TFN listed as 000 000 000. How do I do this? Do I need to reverse the pay and re-enter it, or can I just process another pay for him with no amount/hours, and have this update his TFN for the ATO?

Thank you!

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

August 2020

August 2020

Re: Update Event through STP for Tax File Number

Hi @tonti83

Thank you for your post. What you will need to do is:

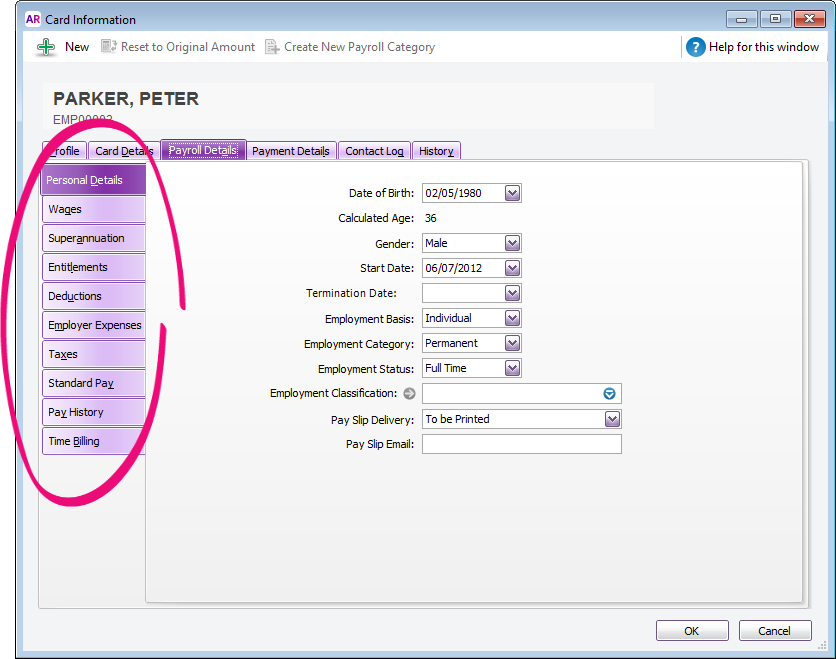

- Go to the Card File command centre and click Cards List.

- Click the Employee tab and then click the zoom arrow next to the employee card you want to enter details for. The Card Information window appears.

- Click the Payroll Details tab. This window is divided into a number of subsections.

- Click a tab on the left of the window to enter payroll details.

- Click on Taxes

- Type the employee’s tax file number in the Tax File Number field.

Here is also a Help Article you might find useful to Terminate an employee in Single Touch Payroll reporting.

Please let us know how you get on and if you have any further questions.

Kind regards,

Jesh

MYOB Community Support

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

August 2020

August 2020

Re: Update Event through STP for Tax File Number

Thank you for your reply, however I was already able to do all this, and I had entered his TFN and processed his pay through STP, but now I need to change the TFN to the 000 000 000 option because he didn't return a TFN Declaration.

I'm wondering if I change it to 000 000 000 in his Payroll Details, and then enter a NIL pay run, whether this will be enough to update this information for the ATO, or whether I need to delete/reverse his pay, and then put it through again with the new TFN information?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

August 2020

August 2020

Re: Update Event through STP for Tax File Number

Hi @tonti83

If update the details and do a $0 pay, this should update the details for the ATO. Please let us know how you get on and if you have any further questions.

Kind regards,

Jesh

MYOB Community Support

Didn't find your answer here?

Related Posts

|

by

Legends1

a month ago

0

123

|

0

|

123

|

||

|

8

|

547

|

|||

|

1

|

199

|

|||

|

3

|

424

|

|||

|

4

|

550

|