Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- AccountRight: Payroll

- >

- STP2

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

STP2

Some of the links and information provided in this thread may no longer be available or relevant.

If you have a question please start a new post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June 2022

June 2022

STP2

Hi,

I managed to update to STP Phase 2, but when I sent an update event, I received a message with" Accepted with errors", but it says the good news that it has been accepted by the ATO.

It says it needs to fix before the next pay run. Cessation Reason code must be provided.

I had a terminated employee -Lump sum A for unused annual leave.

Could you please help and advise? is it something that I have missed? I know the code is T, but I don't know where to put the code. Please advise. Hope to hear from you soon. Thank you.

Kind Regards

Fran

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June 2022

June 2022

Re: STP2

Hi @Fran_29

See this Article about transitioning to Phase 2 under 'Before you begin' - there is a reference to Terminated Employees in the current payroll year. Basically you need to 'undo' the termination and then redo it, this then allows you to add code.

FYI Lumps Sum A - you mention Type T - you may want to check the details with your accountant or tax adviser. Unless an employee is made redundant, only unused annual leave that relates to pre 1993 service is reported as Lump Sum A. Unused annual leave since 18 Aug 1993 is simply included in Gross Income.

Regards

Gavin

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June 2022

June 2022

Re: STP2

Hi gavin 12345,

Thanks for your reply.

The terminated employee is after 1993. It should be included Gross Income.

I have entered the unused annual leave as Lump sum A.

Is there a way that I can change the pay from Lump sum A to Annual Leave and include as Gross Income.

Do I reverse the pay? Thank you

Kind Regards

Fran

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June 2022

June 2022

Re: STP2

Hi @Fran_29

Yes I think you will need to reverse the pay and re-enter it. There are other ways but this is the safest.

I should clarify my comments re Lump Sum A etc. If the accrued leave relates to a period after Aug 1993, the amount is not Lump Sum A unless the termination is caused by things like genuine redundancy. This means that any payout on termination for accrued annual or LSL is simply included as part of the employee's income. There is no special tax treatment for this amount and it is taxed at the employee's marginal rates. So under Phase 1, most employers would use a payroll category such as Unused Holiday Pay in MYOB and assign this to Gross Payments for STP Reporting purposes.

However, while not covered in the linked MYOB Article, Phase 2 requires a whole lot more detailed reporting when it comes to Leave. Any leave or leave related payments must be reported as a Leave Type and not included in the Gross Payments. This particularly affects terminated employees.

This is where things will get tricky for employers as you may need to create more specific payroll categories to accommodate the new reporting requirements. For example Unused Holiday Pay that is not Lump Sum A, needs to be assigned to 'Unused Leave on Termination'. However for genuine redundancy employees, Unused Holiday Pay needs to be assigned to Lump Sum A.

So some employers will need to create and use additional payroll categories, for example Unused Holiday Pay Regular and Unused Holiday Pay Redundancy. This will allow you to assign these to different reporting categories.

Regards

Gavin

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June 2022

June 2022

Re: STP2

Hi Gavin,

Thanks for your reply.

I have changed the terminated employee- Unused Annual Leave to Unused Leave on Termination.

and did another update event. It still come with "accepted with errors"

It is asking for cessation reason code, which is Voluntary.

Could you please help and advise where to add the cessation reason code. It is getting so stressfull. Thank you

Kind Regards

Fran

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June 2022

June 2022

Re: STP2

Hi @Fran_29

From here

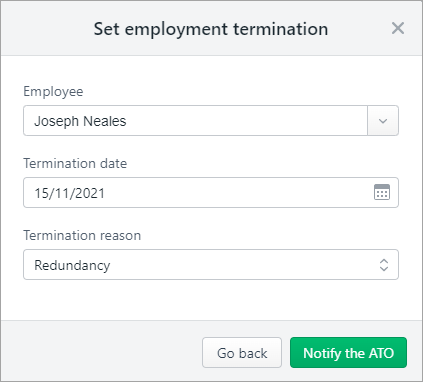

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in using your MYOB account details (email address and password).

- Click the Employee terminations tab.

- Choose the applicable Payroll year and click Add Termination.

- Enter the termination details and click Notify the ATO.

Regards

Gavin

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June 2022

June 2022

Re: STP2

Thanks a lot Gavin.

It works this time.

Kind Regards

Fran

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

July 2022

July 2022

Re: STP2

What about adding areason to emplyees who are already terminated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

July 2022

July 2022

Re: STP2

I also need to add cessation reason to already terminated employees.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

July 2022

July 2022

Re: STP2

Would have been very nice if we could do ALL of these. My client's 5 terminations were all pre-STP2 they are now rejecting and this is an infurating waste of time. The ATO have a lot to answer for with their micro-management of the payroll system. They can darned well volunteer to do this themelves. This is a 8th payroll error from various software I have spent hours fixing.

Didn't find your answer here?

Related Posts

|

11

|

2233

|