So, back on a cold, rainy December day, I wrote about tracking profit in AccountRight. We covered how to create jobs and group them, how to track and claim reimburseable expenses, and how to find out if you’re making money through the reports.

Well, summer’s come and gone and I’m finally bringing you part two of Jobs tracking. Budgets.

It seems some of you are blissfully unaware that you can enter budgets for jobs in AccountRight Standard and Plus, so let's take a quick look at how you'd do this, and why this is a good idea. I know it’s not the most scintillating topic, but trust me, you’ll be thankful.

You can add a budget to any detail job, by clicking the budget icon in the Job Information window.

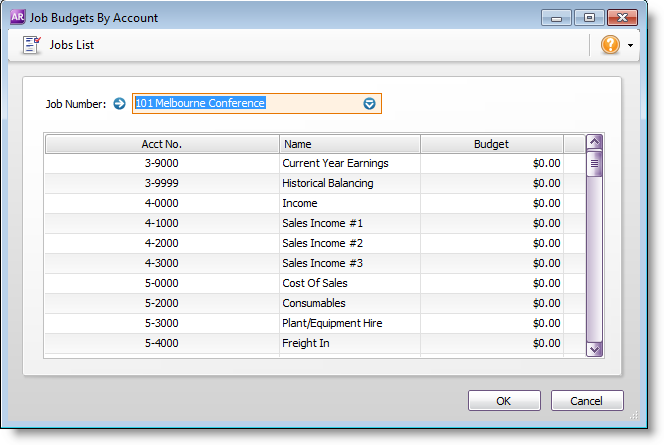

Then enter the budget amount. You can even separate out which accounts you want to allocate the budgets to, so you can budget for both income you'll earn and expenses you'll pay during the job.

So budgets are a great way of confirming at the end of the job where you’re money has been spent and earned in comparison to where you predicted it would be spent or earned.

If you’re constantly underquoting on jobs, tracking job budgets is a great way to find out where you might be going wrong. By entering the budgeted amount for each part of the job before you begin, then examining it at the end, you might begin to see patterns in where you ‘underbudget’, so you can adjust accordingly for future quotes.

If you have long term jobs, budgets can also be very useful helping to work out how much you need to interim invoice.

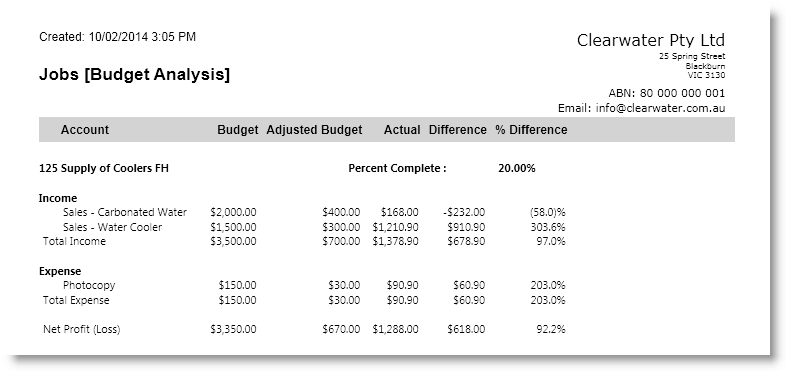

This is where the jobs budget analysis report is a handy little feature. It compares your current profit for your jobs against your budgeted amounts.

What it does really well though, is compare unfinished jobs (make sure you keep track of how complete the job is in the Percent complete field of the Job Information window) with the budget, to see if you're on track. If you check out the % Difference column, you get a very good idea of how you’re tracking to budget.

So, while budgets and job tracking might not be the most fascinating conversation for your next BBQ, it’s a really effective way of checking up where your work is profitable (or not) and whether you’re actually making money.

The latest AccountRight news direct from our product development team.