How excited would you be if I told you that you could save up to 10 hours a month on data entry? And how much more would you love it if I told you that this time saving function is most likely already in your software, but you’re not taking full advantage of it? (Really? Chocolates and flowers for me? Oh, you shouldn't have…)

Anyway, if you’re on AccountRight 2013, and you’re not making the most of bank feeds, then frankly – you’re working too hard.

So what’s so good about bank feeds? Well, in my opinion, one of the best things about bank feeds is that you can set up rules to do the data entry for you.

And why is this awesome? (Apart from *doing the work for you*?)

Well, take me, for example. When I used to have to track my petrol purchases, I was rubbish at entering petrol dockets into my software. I’d lose them, or tuck them into the car door and forget they were there. Now, with bank feeds, I could just set a rule in AccountRight and when the transaction for me filling up came in from the bank, it’d be automatically recorded (and correctly allocated to my car expenses) for me in AccountRight. I could set and forget, knowing that all I’d need to do when I got my latest bank feed was click Approve.

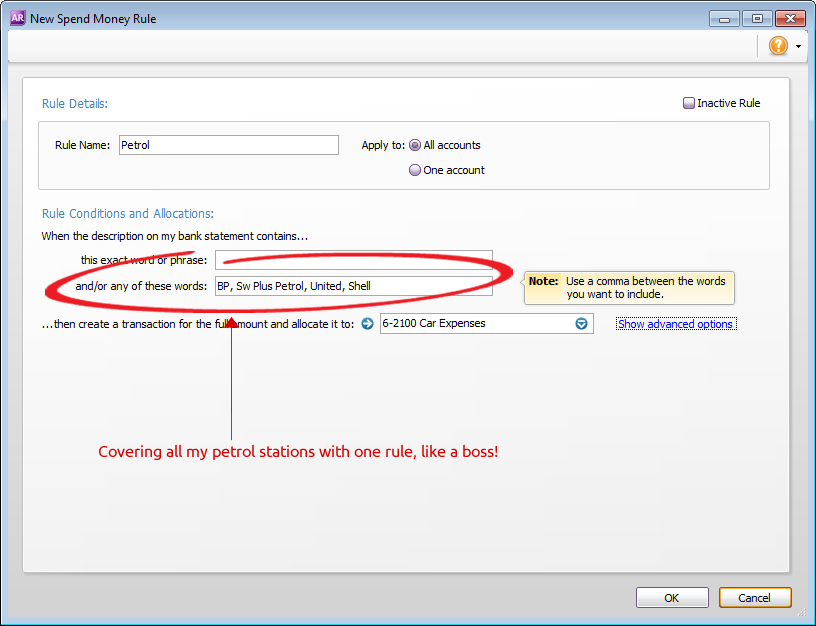

Best of all, because I’m disorganised, and would never go to the same petrol stations, I could set the rule up so it covers all the petrol stations I’d visit. Setting up one rule (like in the image below) would mean I could potentially never stress about petrol dockets again. Ever.

In my books, that’s a winner!

Best of all, there’s no limit to what you can set as a rule – so go nuts if you want.

Then dream about how good it will feel the day every transaction that comes in from your bank via your bank feed is automatically allocated for you via a rule. Leaving you to sit back and hit approve half a dozen times, knowing your account information is correct, up-to-date and already reconciled… or maybe that’s just me.

Loving learning about how to get the most out of your software? Subscribe to this blog, or add it to your RSS feed (You can do this by clicking Blog Options on The AccountRight Blog homepage). We’ll be blogging regularly with handy hints and tips to make you a MYOB champion.