Wine Equalisation Tax (WET) for wine wholesalers

WET is a tricky area of taxation which usually requires assistance from an accounting advisor to set up in your MYOB software.

To learn more about WET, visit the ATO website.

This article is provided for guidance only - it might not be suitable for your business requirements. If you need clarification, check with your accounting advisor or post your question below.

GST on WET

WET is typically calculated as 29% of the taxable supply for a wholesale sale or 29% of the notional wholesale selling price for other dealings.

GST is typically collected on wine sales at 10% of the WET inclusive price.

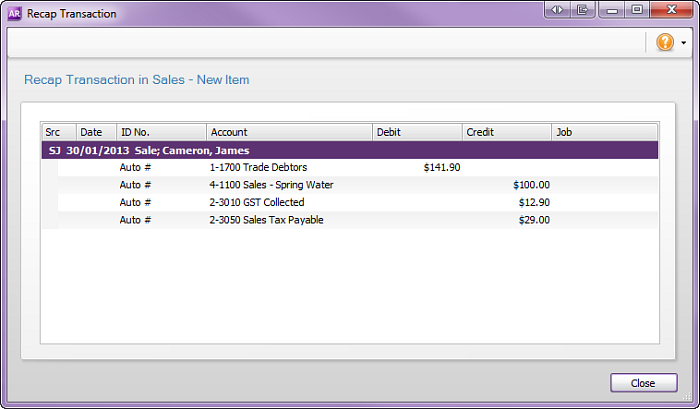

Example for a wholesale sale:

Wine Supplies = $100.00

WET (29%) = $29.00

WET inclusive price = $129.00

GST 10% = $12.90

Total Price = $141.90

WET tax codes

AccountRight and AccountEdge come with a default set of tax codes, including:

- WET (Wine Equalisation Tax) - a Sales Tax type tax code with a rate of 29%

- WEG (GST on Wine Equalisation Tax) - a GST type tax code, with a rate of 12.9%

- GW (Consolidated WEG & WET)

Entering an invoice with WET amount

When entering the details on an invoice, you only need to enter the consolidated tax code GW. The code will assign values to both the WET payable and GST payable accounts. Typically the Tax Inclusive option is not selected.

Here's an example:

Clicking the tax arrow along the bottom of the sale displays the Tax Information window where you can see how the tax has been calculated across the two tax codes.

- Tax Code

- Tax Rate

- Tax Total

- Sales Value