Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- MYOB Business

- >

- MYOB Business: Accounting & BAS

- >

- Variance in GST return and GST report

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Variance in GST return and GST report

Some of the links and information provided in this thread may no longer be available or relevant.

If you have a question please start a new post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June 2022 - last edited June 2022

June 2022 - last edited June 2022

Variance in GST return and GST report

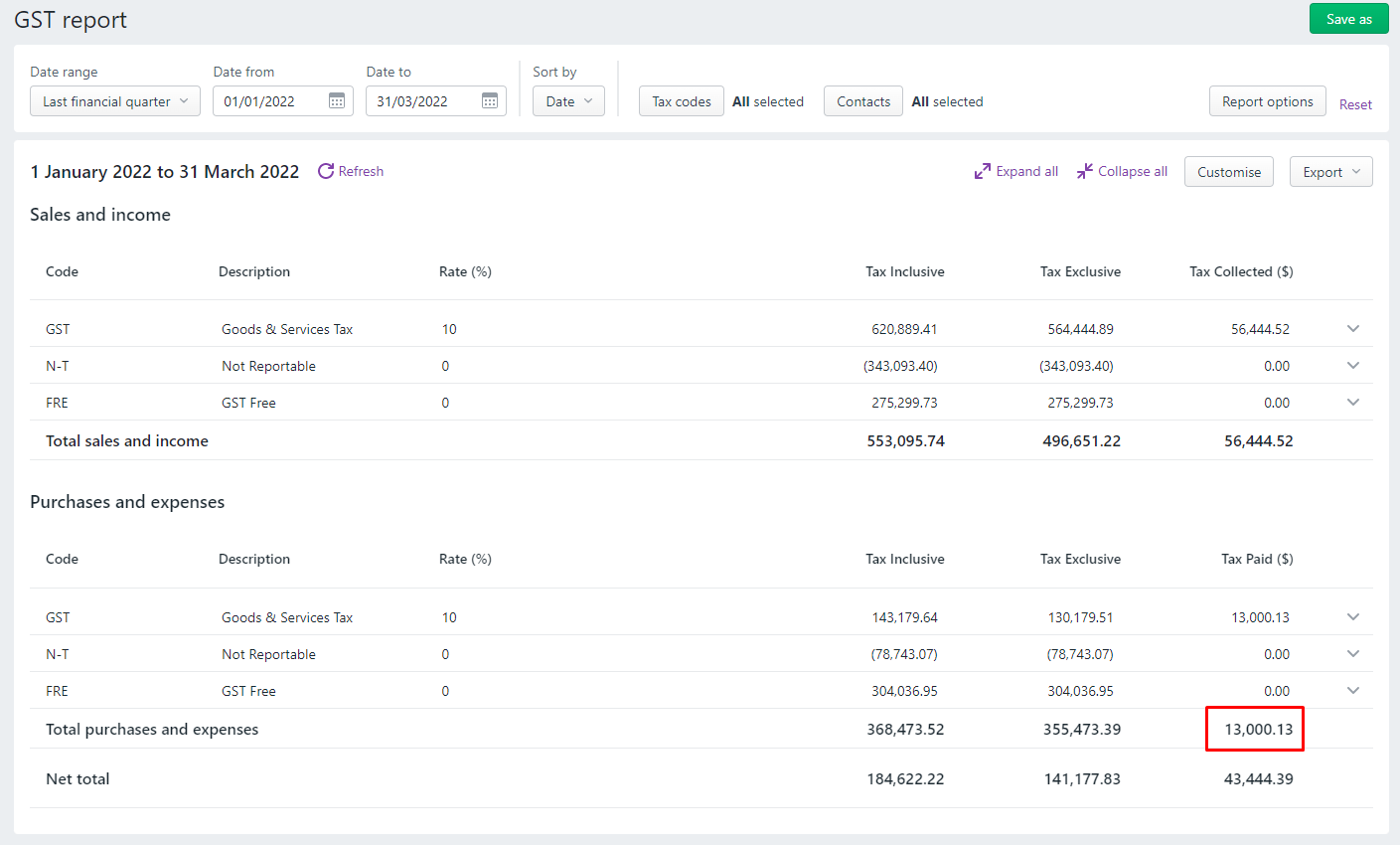

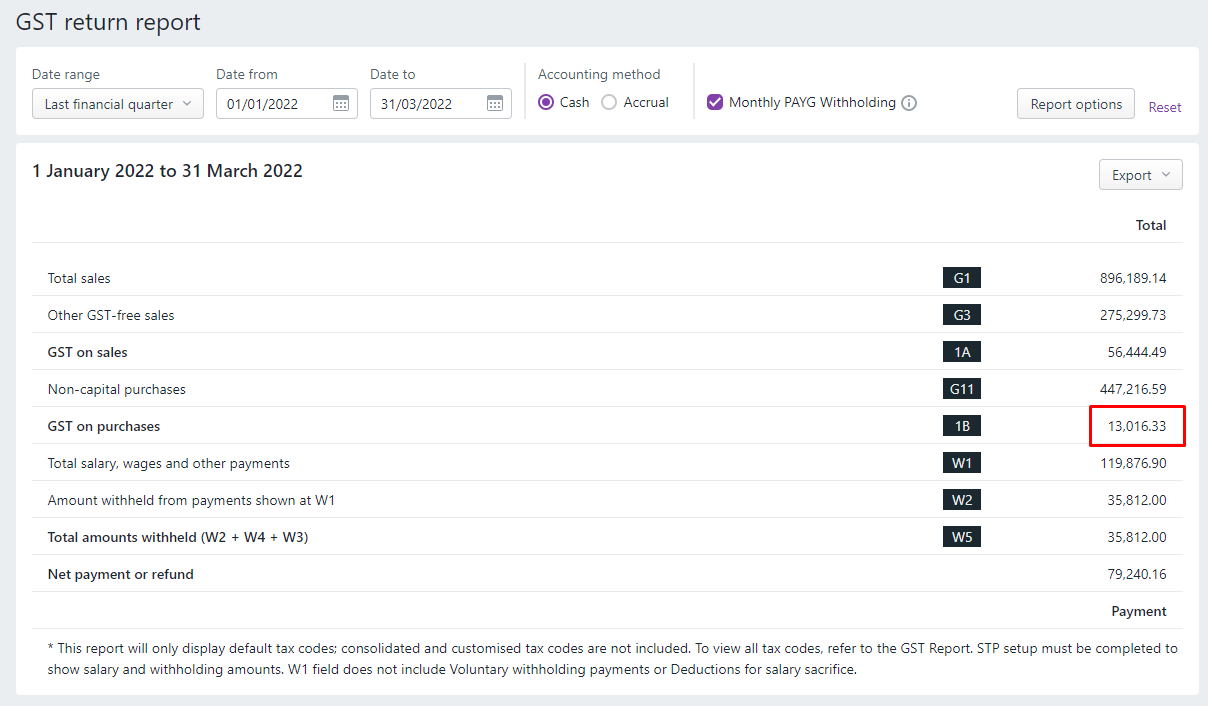

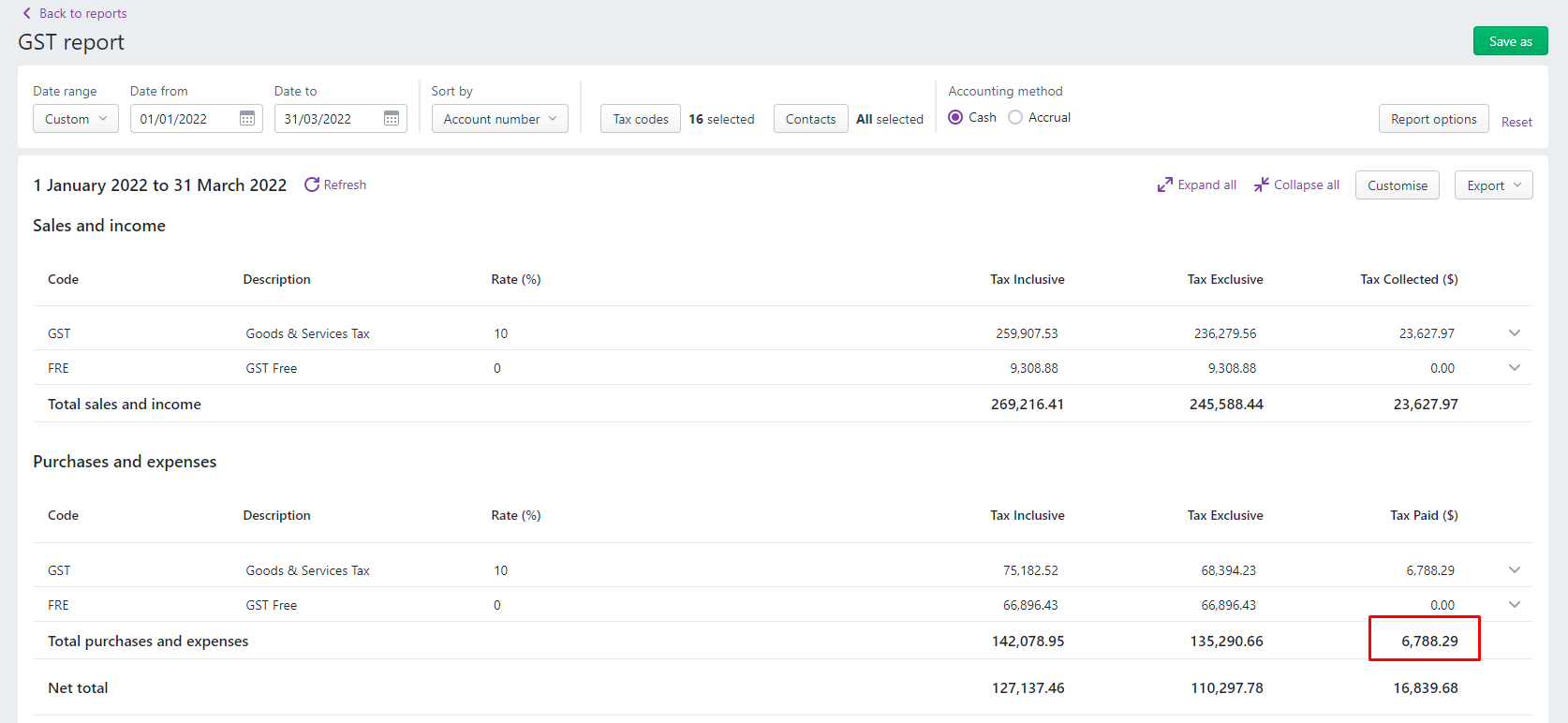

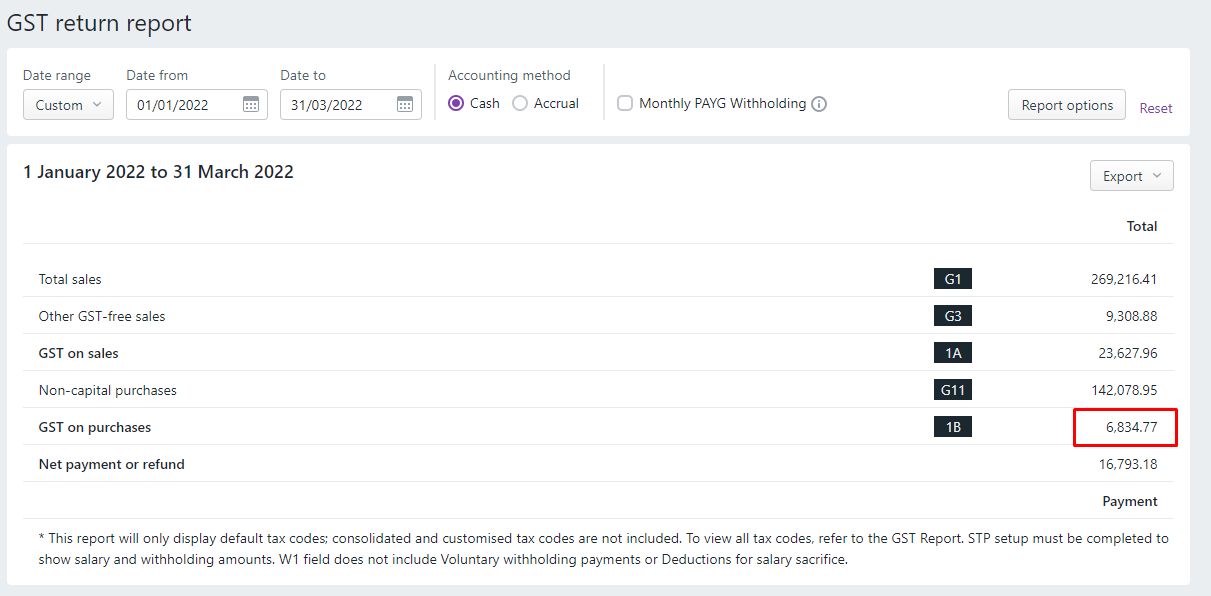

Hi, could anyone please kindly advise why there's a variance between the GST report and GST return? Which figures should I use to report in the BAS?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

July 2022

July 2022

Re: Variance in GST return and GST report

Hi,

Did you get an answer to this question I am having the same issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

July 2022

July 2022

Re: Variance in GST return and GST report

I haven't received any answer for this and still getting the same issue in another file. This need to get fixed asap MYOB.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

July 2022

July 2022

Re: Variance in GST return and GST report

So that I can look into this can you tell me if you have any transactions that include both income and expense accounts? If you go into lodge your activity statements, which amount is prefilled for 1B?

Cheers,

Tracey

Previously @bungy15

MYOB Community Support

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Mark it as a SolutionHelpful? Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

September 2022

September 2022

Re: Variance in GST return and GST report

Hi @Tracey_H , I do have transactions with expense account and asset account. My file is not authorised to lodge BAS from MYOB so I can't check for the prefilled figures in 1B.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

October 2022

October 2022

Re: Variance in GST return and GST report

Hi, I'm having this same issue. Did you ever receive a resolution? I can't work out why the 'GST return report' is showing a different figure at 1B, compared to the 'GST report'.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

October 2022

October 2022

Re: Variance in GST return and GST report

I'm having the same issue. It would be helpful if MYOB would show how an issue was resolved (assuming it was?)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

October 2022

October 2022

Re: Variance in GST return and GST report

@Enough @JosieBaxter , hi, I haven't receive the response from MYOB regarding this but I would recommend you use the figure in the GST report. As I studied, the figure in the GST return is caculated by taking the total purchase and dividing it by 11.

For example in my case, I have some transactions that I allocate as GST but I adjust the tax amount lesser than 10% of the total amount (eg. purchased 11$ allocated with GST, GST supposed to be $1 but I adjusted it to be $0.5). The GST return will report $1 as GST on purchase which is incorrect and the GST report will report $0.5.

On the other hand, if you split the transactions to determine the GST amount and FRE amount, the GST return will report correctly (eg. $5.5 allocated with GST and $5.5 allocated with FRE => $0.5 GST).

That's my case and I think there might be more case which make the variance between the 2 reports. However, hope this will help you to know which report to choose.

Didn't find your answer here?

Related Posts

|

0

|

82

|

|||

|

1

|

183

|

|||

|

1

|

199

|

|||

|

1

|

657

|

|||

|

2

|

427

|