If you’ve simplified your bookkeeping with bank feeds, there’s lots in this release for you to get excited about. It’s also easier to find transactions, order stock, and manage trusts and partnerships.

A big update to bank feeds

Bank feeds (free with your AccountRight subscription) have revolutionised the way Australian and New Zealand businesses keep their books up to date. Take a look at these five big improvements that make approving and reconciling transactions even easier and faster:

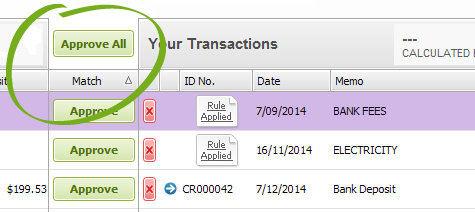

Approve everything with one click

If you’re happy with how AccountRight has matched transactions or applied rules, you can now approve all the suggestions with one click.

Faster one-by-one approvals

Prefer to approve transaction matches one by one? You can now click your way through the list without having to wait for each approval to finish processing.

The Match column is now sortable

It’s now easier to see what’s left to approve. Click the Match column header and all unmatched transactions that are awaiting approval will appear at the top of the list.

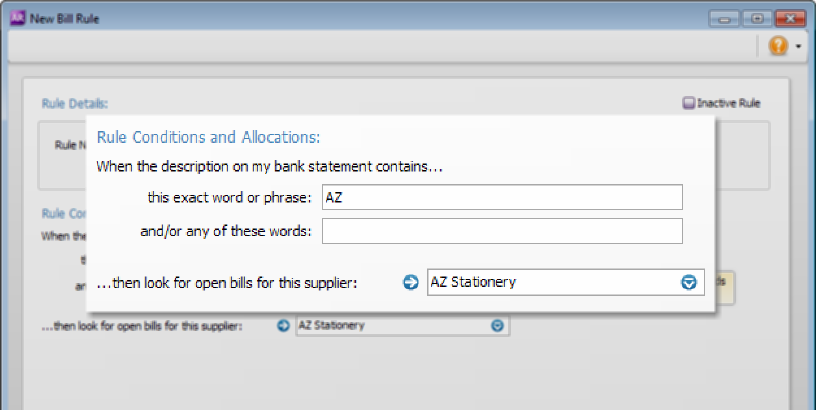

Set up bill payment rules

[Not available in AccountRight Basics] You can now automatically match bill payments that come through your bank feed to the right supplier. With bill rules, payments can be matched to a supplier based on the transaction’s bank statement description.

Reconciling’s never been easier

The Bank Feeds window now shows you the latest statement balance provided by your bank (most banks support this). And if you click the new Reconcile button in the Bank Feeds window, the statement’s closing balance and date will be brought across to the Reconcile Accounts window, making it easier to finish off reconciling your account. See it in action below!

Find transactions faster

The new Search field in the Bank Register makes it easier to track down a payment or receipt. Enter all or part of a cheque number, card name, dollar value, memo or date and your list will be filtered to match your criteria.

And in the To Do List you can also search from any tab, so it’s easier to find recurring transactions, invoices and bills that are due, and the orders you need to process.

Handle profit/loss distributions

Managing profit/loss distributions to partners or beneficiaries was a little fiddly in previous AccountRight versions. Now you just let AccountRight know each person’s profit percentage (go to Setup menu > Profit/Loss Distribution) and everything will be taken care of for you. Learn about setting up profit distributions.

The current year’s profits or losses are distributed to each person’s Current Year Earnings account in real time. When closing the financial year, the amounts are transferred to their Retained Earnings accounts automatically.

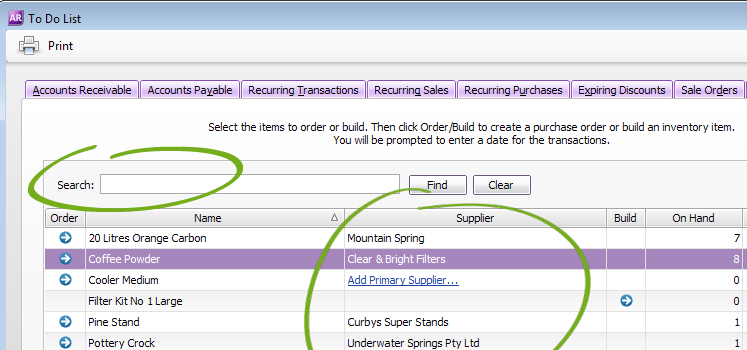

Easily order stock you’re running out of

[Not available in AccountRight Basics] Here’s a bunch of great improvements to the Stock Alert feature (To Do List > Stock Alert tab) that make it easier to order and build what you need:

- Each item’s primary supplier is listed. If no supplier has been selected you can easily add one. This lets you create an order quickly from the To Do List.

- Enter a supplier’s name in the new Search field to see all the items that need ordering from them. With a couple of clicks you can add the items to a single order and send it off.

- All column quantities now display decimal places.

- When ordering items for a single supplier and clicking Order/Build, you’ll see a preview of the order, where previously it would have recorded without being able to review it.

Faster and more stable

With every update, we fix as many bugs and performance issues as we can. Here’s what we fixed in this release:

Performance

- If your contact log entries are recorded for each transaction you enter, some of your cards might have hundreds of entries recorded in their log. In this release you’ll notice speed improvements when selecting these cards in a transaction, and when displaying the Card Information window.

- It now takes less time to delete a transaction when working in large company files.

- Company files up to 1.3GB can now be uploaded into the cloud.

Recurring transactions

- Recurring transactions scheduled to record automatically will do so, no matter which user logs in to AccountRight. Previously a recurring transaction would only record automatically when the user who was to be notified logged in.

- An issue where monthly recurring transactions showed incorrect due dates was resolved.

Time billing

- You can filter the Multiple Activity Slips window to a date range. Previously all activity slips entered for a supplier or employee would be listed, which slowed things down.

- In the Prepare Time Billing Invoice window, you can select the activity slips you want to include on the client’s invoice. Previously all WIP activities would appear on a client’s invoice, whether there was an amount in the Bill column or not.

- Rounding issues that caused clients without WIP activities to appear in the Time Billing Customers window (Time Billing command centre > Prepare Time Billing Invoice) have been resolved. Previously some clients who had been fully invoiced would appear in the list with just a few cents of WIP outstanding.

- If while preparing a time billing invoice you would change its status to a quote, a crash would occur when you later attempted to convert it to an invoice. This has been fixed.

Reports

- Producing reports at more or less than 100% scaling would cause some report lines to be hidden when spanning multiple pages. This has been resolved.

- When entering dates into the report filter, the date will now be applied by default to subsequent reports you produce in that session.

- Issues causing the Aged Payables report to show different totals to the Payables Reconciliation report have been resolved.

Setup

- If the Warn for Duplicate Invoice Numbers on Recorded Sales option is selected, you’ll now also be warned if a number has been assigned to an order.

- [Australia] The default No ABN/TFN tax rate for new company files has been updated to 49% (up from 46.5%, this new rate is effective from 1 July 2014). Tax code rates in existing company files will not be updated automatically. See Support Note 9484 for information about updating this tax rate.

Importing

- When importing account budgets, you’ll now see a warning if an account you’re importing information for isn’t in the accounts list.

- Rounding issues that caused some sales and purchases not to import successfully have been resolved.

Get the update

This update is rolling out to all AccountRight subscribers over the next few days. If you’re using AccountRight 2013.1 or later (Australia), or 2013.2 or later (NZ), you'll be prompted to update when you open your company file. Or, you can download the installer by signing in to my.myob.com.au or my.myob.co.nz .

Using an older AccountRight version? Visit the AccountRight Upgrades and Updates page on the MYOB website to download the latest version: (AU | NZ).