Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- AccountRight: Payroll

- >

- Re: EOFY

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

EOFY

Some of the links and information provided in this thread may no longer be available or relevant.

If you have a question please start a new post.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

September 2022

September 2022

Re: EOFY

Could I do a pay run dated 30/06/2022 witht the missing amount. Then after it is processed, reverse it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

September 2022

September 2022

Re: EOFY

Hi @LLSH

As per this Help Article, About backing up company files, online files are automatically backed up weekly and retained for six months. This is not the same as a user backup, we do recommend users back up their files regularly. If you don't have a backup we do offer a backup retrieval service: Backup retrieval

Reversed pay runs need to be reported to the ATO through STP. If you processed a payrun to correct the YTD amounts, they will be incorrect again once you process the reversal so won't resolve your issue.

You will need to follow the steps in the previously linked post, Payroll activity and Payroll register are not the same, to resolve this.

Please let me know if you need further help.

If my response has answered your enquiry please click "Accept as Solution" to assist other users find this information.

Cheers,

Tracey

Previously @bungy15

MYOB Community Support

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Mark it as a SolutionHelpful? Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

September 2022

September 2022

Re: EOFY

Thanks Tracey, I am still wondering how the amounts can change when we haven't altered anything?

Is this something to do with STP1 and STP2? I feel like its a reporting issue in MYOB. The amounts are so different in the 2 reports that there is no way they could be altered to this degree.

I feel like there is another solution to this that doesn't require altering the pay history which I am not even sure how to do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

September 2022

September 2022

Re: EOFY

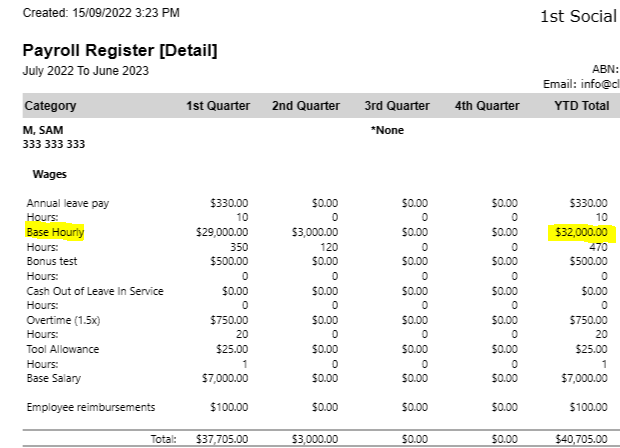

FYI I have attached a copy of the register detail.... This is not a manually adjusted report as you can see.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

September 2022

September 2022

Re: EOFY

Hi @LLSH

As explained previously and in my post, Payroll activity and Payroll register reports are not the same:

The Payroll activity report pulls it's data from pays processed through Process payroll.

The Payroll register report pulls it's data from the employee card>>Pay history.

The YTD verification report and Summary of payments reports in STP also get their data from the employee card>>Pay history.

This means that:

- if the pays processed through payroll are gross YTD $52,000 - the activity report will show $52,000

- if the employee card>>Pay history is gross YTD $32,000 - the register report and STP reports will show $32,000

The Pay history should be the employee's actual YTD amount, according to what has been processed and paid in Process payroll.

Manually changing the Pay history is done by going to employee card>>Pay history and overtyping the amounts in the fields.

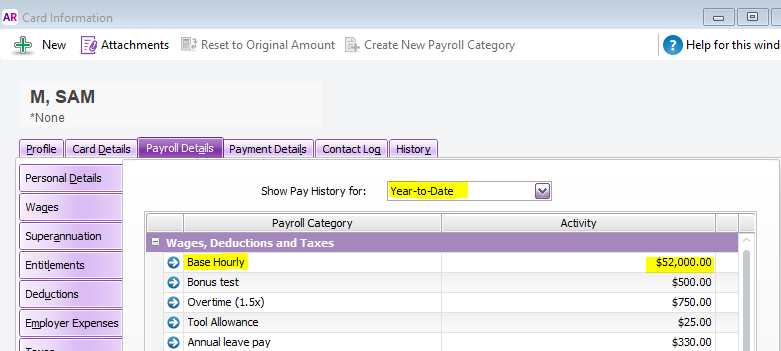

This employee's YTD for the Base hourly payroll category is $52,000:

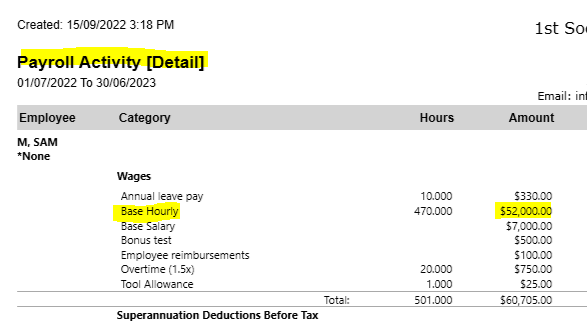

The activity detail report shows base hourly $52,000:

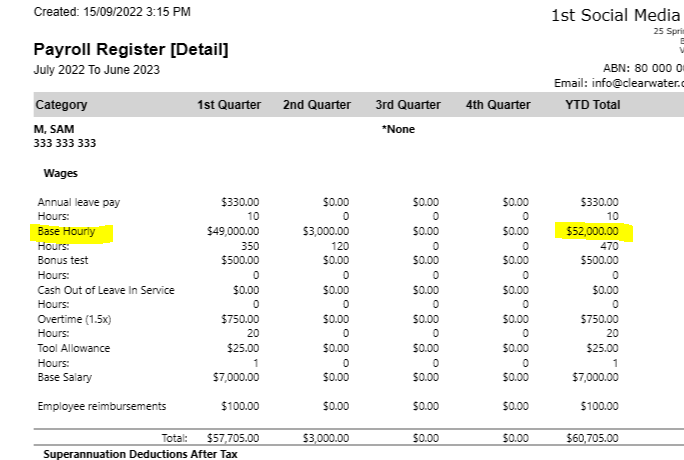

The register detail report shows base hourly $52,000:

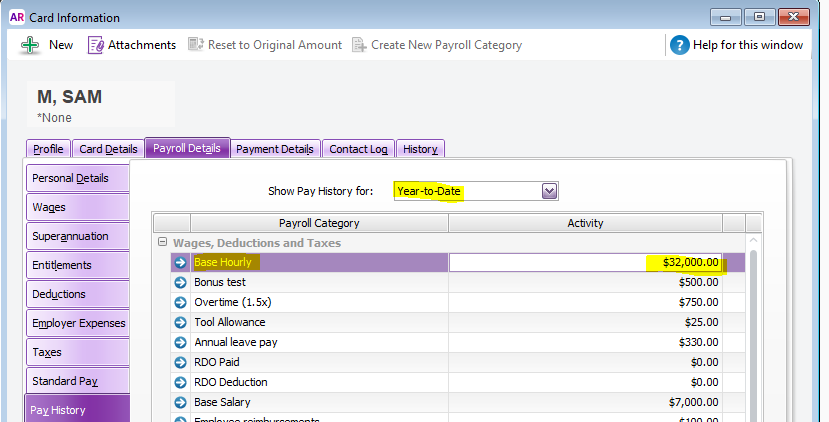

I go into the employee card>>Pay history and manually overtype the Base hourly amount to $32,000:

I re-run the activity report and base hourly is still $52,000:

I re-run the register detail report and base hourly is now $32,000:

The only way to resolve this issue is to restore a backup and fix the employee's Pay history.

Something else to note is that the Payroll Summary report (Payroll>>Payroll categories) also gets it's data from the employee card>>Pay history. This means that if the Pay history is incorrect this report will also display incorrect values.

Please let me know if you need further help.

If my response has answered your enquiry please click "Accept as Solution" to assist other users find this information.

Cheers,

Tracey

Previously @bungy15

MYOB Community Support

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Mark it as a SolutionHelpful? Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

September 2022

September 2022

Re: EOFY

Thank you I have restored an earlier version and updated the information. How do I report the updated information to ATO as I can't do a zero payrun in the back up version? When I look at the current version it is still showing the incorrect amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

September 2022

September 2022

Re: EOFY

Hi @LLSH

If you have moved to STP Phase 2 you need to follow the exact steps in the previously linked post:

- Take a back up of the current online file

- Restore a back up taken on or prior to 30 June

- Fix the amounts in the employee card>>Pay History

- Process a $0 pay with payment date as 30 June

- Once the YTD verification report is correct finalise STP

- Take a back up

- Restore the back up of the current online file

If you have moved to STP Phase 2 you will need to restore the previous year back up online. Make sure you take a back up of the current online file before restoring the back up so that you do not lose current year data.

If you are still on STP Phase 1 can you please provide detailed information on why you can't process a $0 pay in the back up? Are you getting an error?

Cheers,

Tracey

Previously @bungy15

MYOB Community Support

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Mark it as a SolutionHelpful? Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

September 2022

September 2022

Re: EOFY

Good Morning, I have accountright desktop version so I am confused about how to merge the back up and the current file. I have upddated the informtion on the back up file but thats as far as I can get as It won't let me send to STP. Yes I am on STP 2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

September 2022

September 2022

Re: EOFY

Hi @LLSH

You need to follow these steps exactly so that you can finalise STP and don't lose any of your current data:

- take a back up of your current online file

- restore the previous year back up online: Restore your company file

- fix the Pay history

- process a $0 pay with payment date as 30 June 2022

- once the YTD amounts in the Summary of payments report are correct, finalise STP

- take a back up and rename it so that it is easily identifiable as the EOFY back up

- restore the back up of the current file online (the back up taken at step 1)

You can't merge the back up and current files. You need to fix and finalise STP in the back up file. Files need to be online to report and finalise STP. So you are replacing the current file with the back up file. When you have finalised STP you need to replace the back up file with the current file.

Make sure you take a back up of your current file before restoring the previous year back up.

Please let me know if you need further help.

If my response has answered your enquiry please click "Accept as Solution" to assist other users find this information.

Cheers,

Tracey

Previously @bungy15

MYOB Community Support

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Mark it as a SolutionHelpful? Leave a to tell others

- « Previous

-

- 1

- 2

- Next »

Didn't find your answer here?

Related Posts

|

3

|

1420

|

|||

|

by

2

2312

|

2

|

2312

|