Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- MYOB Business

- >

- MYOB Business: Reports

- >

- Contractor's GST not showing in GST report

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Contractor's GST not showing in GST report

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 weeks ago

2 weeks ago

Contractor's GST not showing in GST report

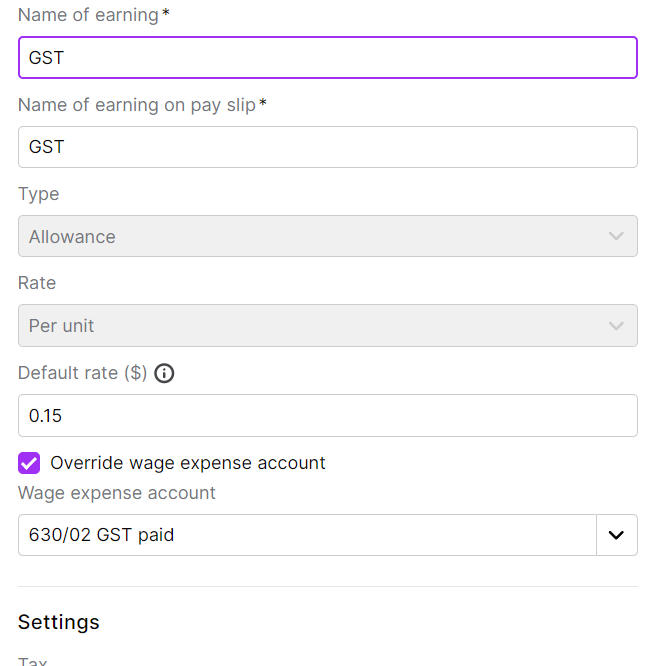

I processed a wage payment in payrun to a contractor who is GST registered. I set up the GST payment as shown in the picture.

After I recorded the payment, the GST amount didn't show in the GST report.

Can anyone tell me what I need to do to get it shown in the GST report? So I can claim the correct amount of GST later.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

a week ago

a week ago

Re: Contractor's GST not showing in GST report

Hi @zero77,

Thanks for your post.

Adding a GST pay item in a pay run won't show up in the GST report because it's not linked to a GST code.

Generally, contractors are treated one way or another. You may pay them as an employee with withholding tax taken out. Typically, GST would not also be taken out in this scenario.

Otherwise if they're invoicing you and charging GST then typically they would be treated as a supplier. Click here for more information.

If you are unsure which scenario applies for this contractor we would recommend speaking to your accountant.

Feel free to post again anytime if you require further assistance.

If my response has answered your inquiry, please click "Accept as Solution" to assist other users in finding this information.

Best regards,

Doreen

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Accept it as a Solution

Leave a to tell others

Didn't find your answer here?

Related Posts

|

0

|

79

|

|||

|

1

|

183

|

|||

|

1

|

199

|

|||

|

1

|

651

|

|||

|

2

|

423

|