Take the stress out of compliance work with the latest release of AccountRight.

Easier payment summaries (AU)

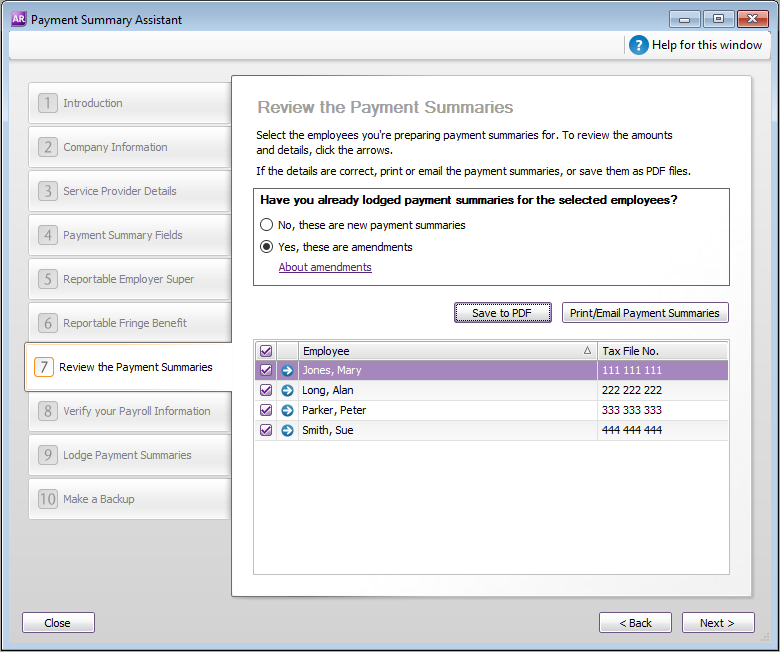

This year the ATO requires all businesses to submit their payment summary information (known as the Payment Summary Annual Report, or EMPDUPE) online using the ATO Business Portal. So we’ve updated the Payment Summary Assistant to reflect the requirement changes.

But in bigger news, we’ve implemented two of the most popular requests for payment summary improvements on the AccountRight Ideas Exchange:

- Payment summary amendments: If you lodge a payment summary, and later realise there was an error or you forgot to include some required information, you can now prepare an amended payment summary using AccountRight, and create an EMPDUPE file that’s lodged using the ATO’s Business Portal. No more paper forms for amended payment summaries.

- Email payment summaries: You can now email original and amended payment summaries to your employees using AccountRight or Microsoft Outlook, direct from the Payment Summary Assistant.

You can still save PDFs to your computer for your own records, but the new emailing feature will save lots of time distributing the summaries to your employees.

|

Easier to get SuperStream compliant (AU)

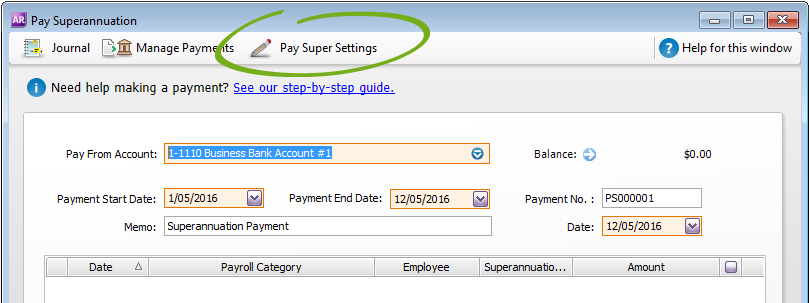

All Australian businesses need to be SuperStream compliant by 30 June this year. So if you haven’t already signed up for MYOB Pay Super, the gold-certified SuperStream service that lets you make super payments straight from AccountRight, now’s the time to do it.

We’ve made it even easier for you to sign up for MYOB Pay Super and to manage your payments in AccountRight. There have been lots of tweaks that’ll help you get on board easily, including:

- An improved Pay Super application form and bank verification process that makes it easier to get started.

- Improved help and step-by-step guides that you can access from the Pay Super windows just in case you get stuck or need a refresher.

- You can now review your Pay Super details, such as your payment limit and who’s been set up as an authoriser, from AccountRight. Click Pay Super Settings in the Pay Superannuation window to get the details. Soon, you’ll also be able to change some of the details online without having to fill in any paper forms.

- After you verify your bank account we’ll now automatically set each fund in your file to be payable via Pay Super. But you should still review the funds to ensure the registered name and any missing details have been entered.

|

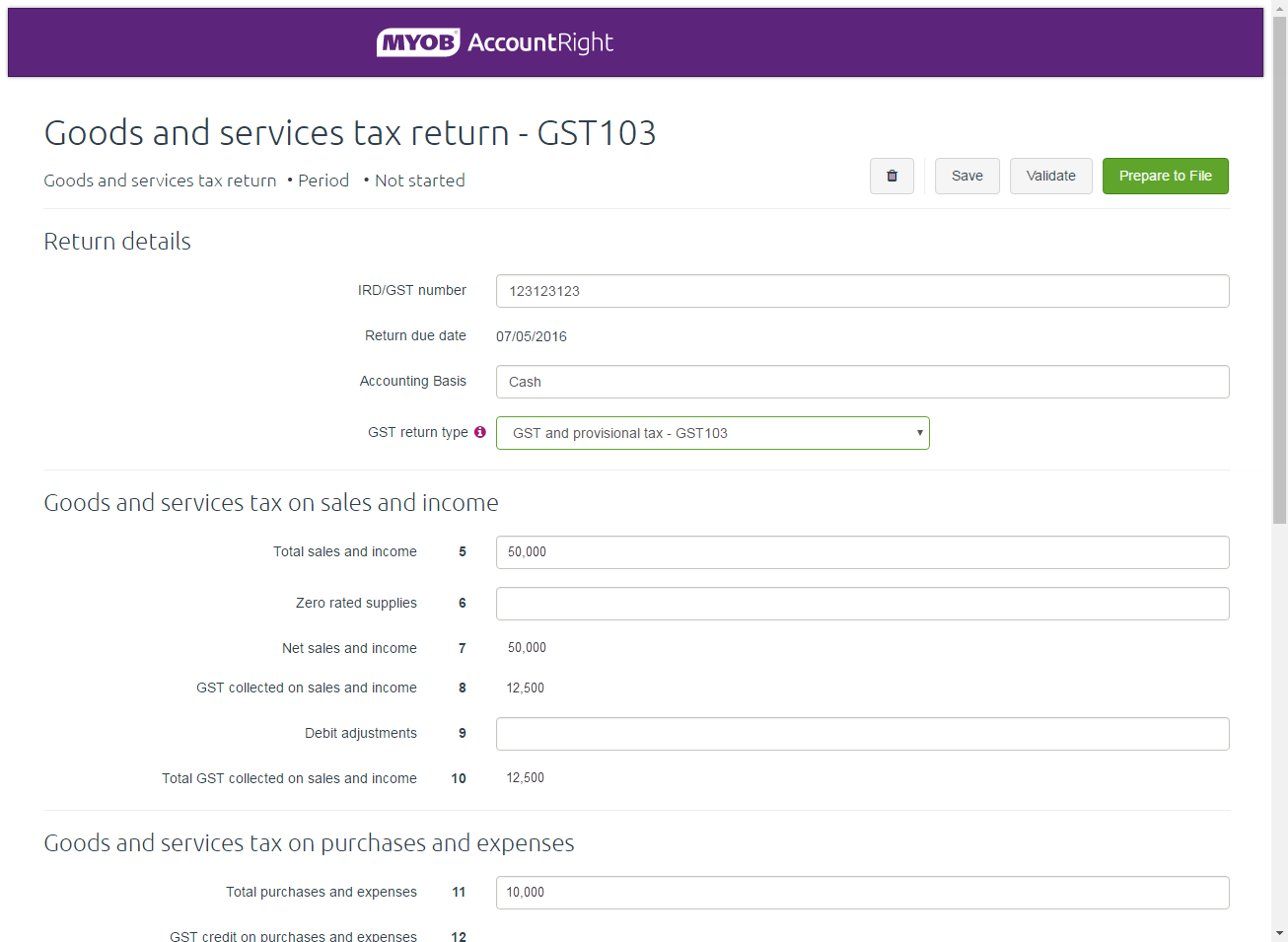

Easier GST reporting (NZ)

We’ve worked with Inland Revenue to help make filing and tracking GST returns much easier for you. Soon you’ll be able to file your GST returns straight from AccountRight, with no paper forms to fill in.

A few MYOB partners and clients are already trialling this feature, and over the next few weeks we’ll be rolling it out to everyone - we’ll let you know when it’s available to you.

Here’s a sneak peek at how it’ll work.

- Click Prepare GST Return in the Accounts command centre.

- Log into your MYOB account.

- Set up your return and check over the totals that are filled in for you.

- If you’re happy with the totals, you can file it on the spot with Inland Revenue.

Note that if you’d rather file manually, you can still print a GST Return report and use it to complete the paper form, just like you did in previous releases.

|

More improvements and bug fixes

We’ve also fixed several issues and improved the usability of frequently used windows and reports:

Banking

- You can now resize the Print/Email Remittance Advices, Print Receipts and Print Cheques windows.

- The Print Receipts window now lists transactions sorted by date (oldest first) by default, instead of by amount.

- Bank feed rule names that started or ended with a space character previously caused errors. Now the space characters are automatically removed.

Reports

- The default widths for amount columns on the Balance Sheet, Receivables Reconciliation (Summary) and Payables Reconciliation (Summary) report are now wider so you won’t need to resize them manually each time you prepare these reports.

- Fixed an issue that caused the Item Transactions report to display transactions only for the last month of the financial year.

- AccountRight no longer crashes when adding a job-related field to the Item Transactions report.

- The Activity Slip [Customer Detail] and Activity Slip [Employee Detail] reports no longer display non-chargeable activity slips when the Work in Progress Only filter is selected.

- The Price Level filter in the Inventory Price List [Detail] report now displays correctly.

- Corrected the spelling of “Activities” in the Statement of Cash Flow report.

- API and reporting issues caused by rolling back a financial year have been resolved by creating new reversal business event lines.

Suppliers and purchases

- The Select from List window that appears when you select a supplier with outstanding quotes or orders, now shows the purchase type of each transaction (quote/order).

- The Remittance email address in the Supplier card is now validated when added or changed.

- If the Delete Quotes Upon Changing to and Recording as an Order or Bill preference is selected, the quote window is now automatically closed when it’s converted to an order or bill. Previously it would remain open, and would cause a crash when attempting to save the quote.

Employees and payroll (AU)

- An issue that caused the Payment Summary Information window to not show information for Labour Hire employees has been resolved.

- When editing a recorded pay, the Pay Period Start or Ending date fields will be validated. Previously if the fields were cleared and left blank, AccountRight would crash when making a payment via Pay Super.

- Fixed an issue that caused AccountRight to crash when printing a blank timesheet.

Emailing

- We fixed an issue that prevented emails from being sent when the recipient's email address had a top level domain consisting of more than three characters, for example .info.

How to update

This update will be available to all AccountRight subscribers in Australia and New Zealand over the next few days. If you’re using:

- AccountRight 2016.1 or earlier: You'll be prompted to update when you open your company file. Or, you can download the installer by signing in to my.myob.com.au or my.myob.co.nz.

Tip: After installing the update, look for the new 2016.2 icon on your desktop or in the Start menu. Make sure you start AccountRight using the new icon. - AccountRight v19 or earlier: Visit myob.com/upgrade to download this release.

|