LydB64

5 years agoExperienced User

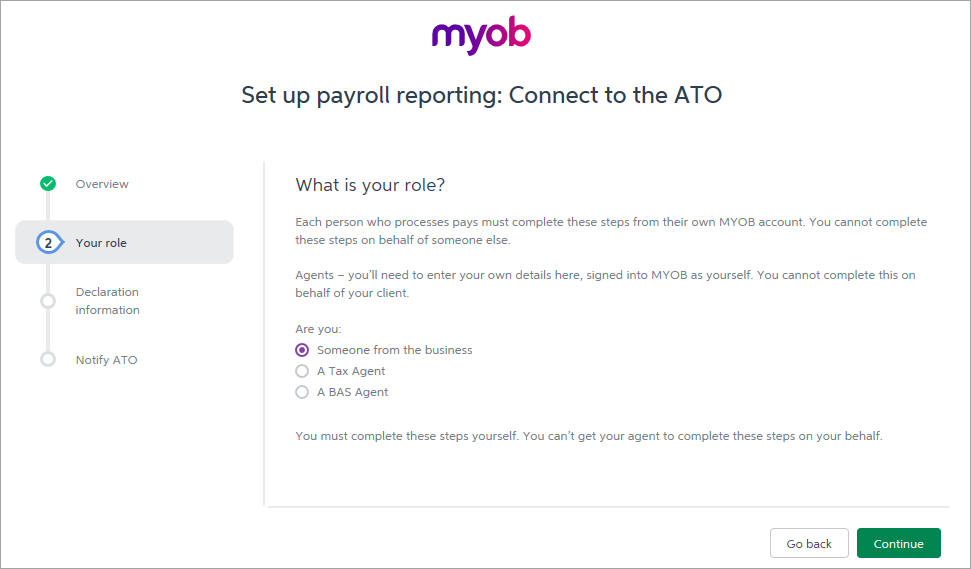

Declarer for STP

I have an offsite contractor (not an employee) who processes our payroll. When registering as a declarer it gives three options 1/ someone working in the business 2/ tax agent 3/ bas agent.

As she is technically neither of these, how does she go about recording pays for STP to the ATO please?

Hi LydB64

As those are the only options, I suggest you call the ATO to confirm.

You should also check that they are legally allowed to process your payroll.