MYOB Account right does not process job costing properly in terms of standard accounting principles as has been described in all accounting text books which means that the profit and loss that is being reported each month may not be correct as it will be distorted by income not necessarily being reported in the period in which the costs have been reported unless journal entries are prepared to adjust for these differences. Profit and loss reports are also distorted by the inclusion of job costs with normal ongoing costs which makes the job of analysing such costs difficulty unless journal entries. p

This problem could be solved very easily by setting up revenue and cost of sale accounts for each class of jobs and a work in progress (balance sheet account) for each job. MYOB would need to have a category set up for each type of cost that a business usually uses for its business such as material purchases, labour, subcontractors , inventory items etc so that the estimates can be entered under these categories rather than using general ledger accounts. Whenever any posting is made to a job, that posting shall be the work in progress account no to that job followed by the category code for that cost. Alternatively that category code could be entered as the account code which would mean that the system would require a job no and post the item to the WIP account for that job. When a job is completed or all jobs have been completed in a period, a program would then be required to be run that would transfer the revenue and costs for such jobs to the Revenue and Cost of sales for that job with the balance being charged to WIP. This program would be able to be rerun so that any errors can be picked up and corrected. The program would also pick up costs and revenue that have been incurred after the actual date of completion which would need to be entered. This approach can also apply to internal projects and also to import shipments with the difference being than the appropriate GL account would be posted to instead of Revenue and Cost Of sale account.

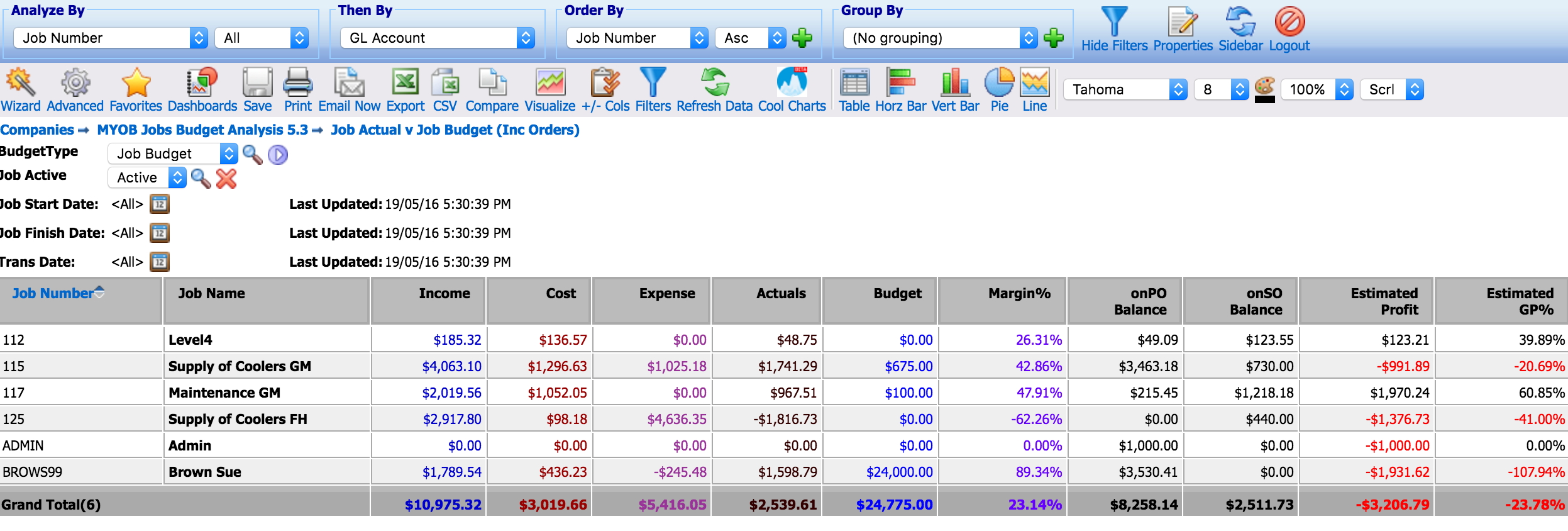

There should be a reporting facility in place that would enable you from either the revenue or cost of sales accounts to drill down to the jobs making up the entry with one line per job showing revenue, Cost of sale, Gross margin and gross margin % ideally in a sort sequence of margin % (the worst margins showing up first) and then an ability to drill down to a selected job so that the user can determine what has happened in the job .

A business would now have consistent reporting done within the system itself and users would be able to focus on the business with the profit and loss report showing the performance on jobs and the costs that are incurred normally by the business. The actual completion of a job is the only time that the profitability of a job can be properly measured and this is the time when the profit and loss account should clearly show the true gross margin with that important capacity to drill down to jobs to see why the performance did or not meet expectations with a capability for better analysis by the use of standard category codes suited to the business.

The system would need to have a capability to bring forward the revenue and cost transaction included in Work in progress an accounting period is rolled over. The changes that MYOB would need to make are not to my mind particularly onerous but the benefit to all users of job costing would be huge as the reporting of profits and losses would be in line with existing standards which apply to small business as much as they do to larger businesses. For those businesses that prefer to use current process, MYOB could always set up the use of the suggested process and the current process as options.

'Work In Progress"