Capital Purchases and Finance in AccountRight

HOW TO RECORD CAPITAL PURCHASES AND FINANCE IN ACCOUNTRIGHT

There are many finance options available to purchase capital equipment. Commonly used in Australia are:

- chattel mortgages: ownership of the item transfers to the business when the lending company pays the supplier of the goods.

- hire purchase: ownership of the goods remain with the lending company until the agreement is paid out.

- lease agreements: ownership stays with the leasing body and the goods are never owned by the business.

- personal loans: these loans are usually from those close to the entity (e.g. directors, family or benevolent friends) and can be treated in the same manner as a chattel mortgage.

This article will focus on chattel mortgages as it is the most commonly used within the SME community. It will look at:

- purchase of capital equipment with a long depreciation period (e.g. warehouse racking or workshop machinery)

- repayments

- handling purchases of motor vehicles.

PURCHASE OF ITEMS

Prior to recording the purchase transaction in AccountRight, you need to:

1. Assemble all the necessary paperwork – these may include:

- details of the purchase including any relevant serial numbers

- details of any deposits paid

- details of the disbursement from the loan document

You should also determine:

- The total cost of the loan

- The amount of interest payable

- Establishment fees

2. Discuss with your accountant as to how they would like the items recorded in the Balance Sheet. They may be happy with it being recorded under one of the generic accounts, or they may ask that it be set up as a new account on the Balance Sheet.

- Every capital account must have an account immediately below it to show the depreciation accumulated to date. For example:

1-2901 Machinery At Cost CAP

1-2905 Machinery Accum. Depreciation N-T

Or

1-2910 CNC Bridgeport Mill CAP

1-2950 CNC Mill Accum. Depreciation N-T

- The loan must be established on the chart of accounts with an account called ‘Unexpired Interest’ (see below). This is always set up as a Liability Account (Long Term) and is normally done as a Credit Card type account, so that money can be spent from and received into this account.

2-2100 ABC Loan for CNC Mill N-T

2-2105 Unexpired Interest on ABC Loan N-T

- In AccountRight, you do not receive money from the loan company – the loan is always populated by spending money from it.

Entering the transactions in AccountRight

In the example below, the equipment bill is listed as $89,590.20 with an interest of $12,863.05, totalling $102,453.25. The loan is to be paid back over 48 payments – 47 payments of $2137.57 and one payment of $1987.46.

- Create a card for the finance company. In our example, we’ll call it ‘ABC Loan’ .

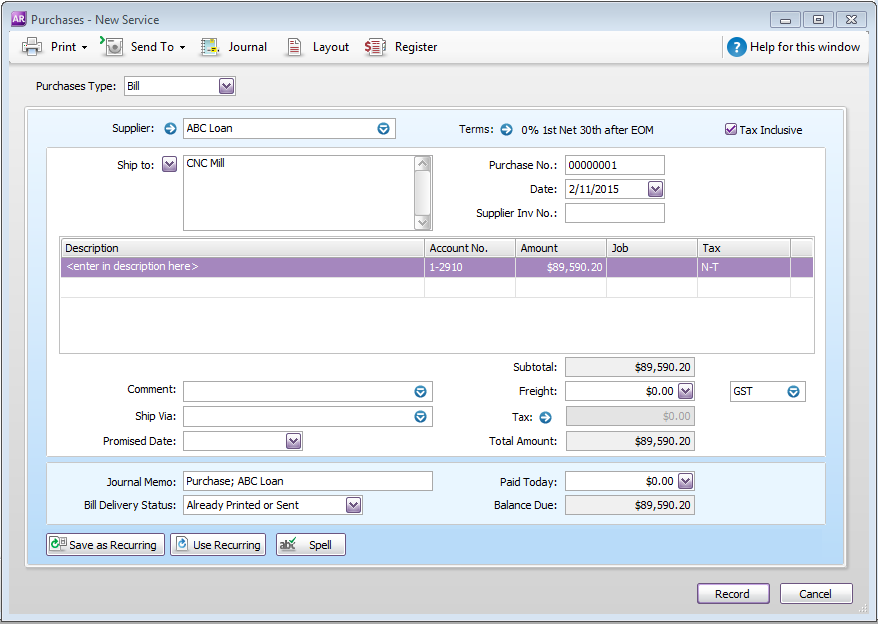

- Create a purchase transaction for the equipment ($89,590.20), bearing in mind the following:

- Enter in detailed information (e.g. description of the item, particularly serial numbers, and information on warranty)

- The account should be the 1-xxxx determined earlier

- If you have multiple locations, it should also define where the item is to be located

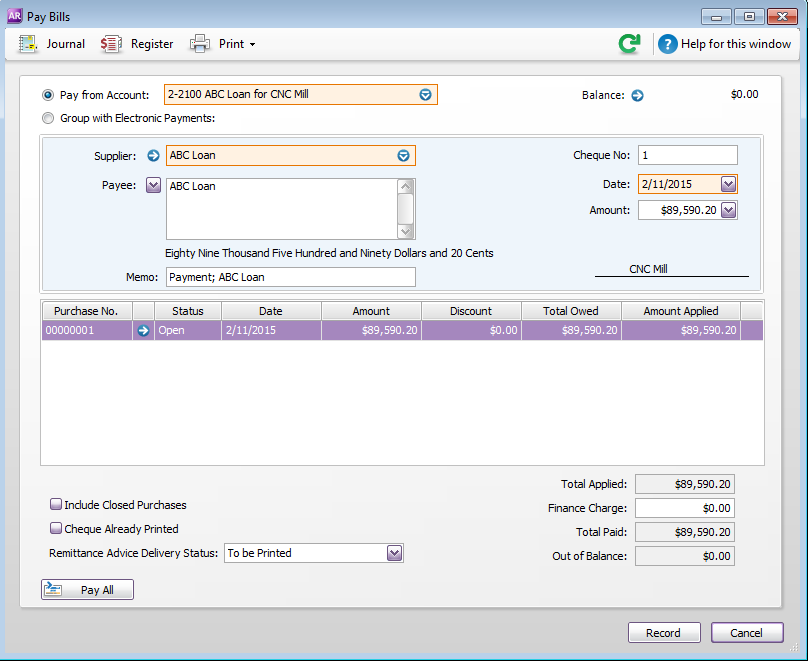

3.Pay the bill, selecting the ‘Pay from Account’ as the 2-xxxx loan account set up earlier and entering in the amount of the loan ($89,590.20).

Upon recording this example transaction, both the 1-xxxx account and the 2-xxxx account now have a value of $89,590.20.

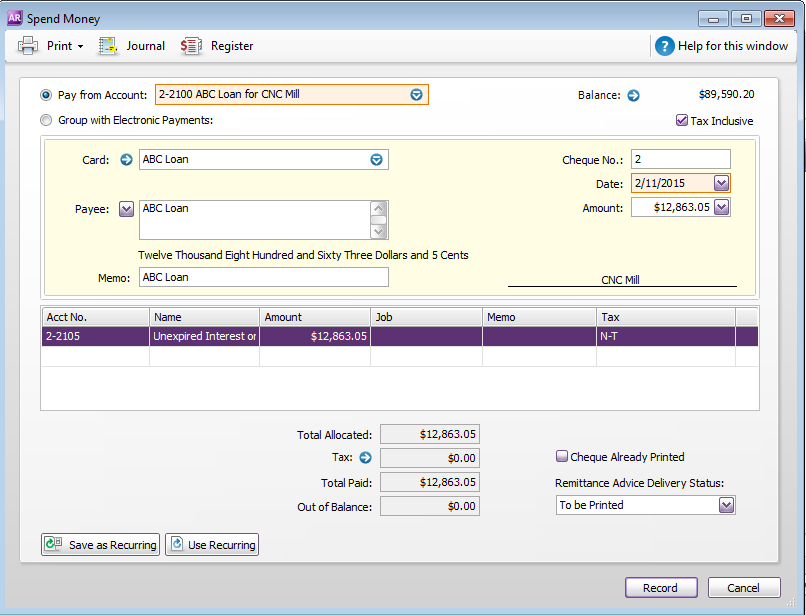

4. Create a Spend Money transaction with the 2-xxxx loan account as the Pay from Account, and the Acct No. as the 2-xxxx Unexpired Interest account. In our example, the unexpired interest amount is $12,863.05.

In our example, the accounts now look like this:

That is the last time you’ll need to touch the 1-xxxx accounts until the accountant finalises the accounts and gives you a depreciation figure.

A word of warning – unless you are familiar with the depreciation schedule that the accountant is using you should not attempt to determine the depreciation yourself. The depreciation is normally journaled in as part of the alignment journal and the other side of it is Depreciation on the P & L.

REPAYMENT OF LOAN

Making your first Payment

As the establishment fee is normally added to the first payment, the first payment may be slightly higher than the remaining payments.

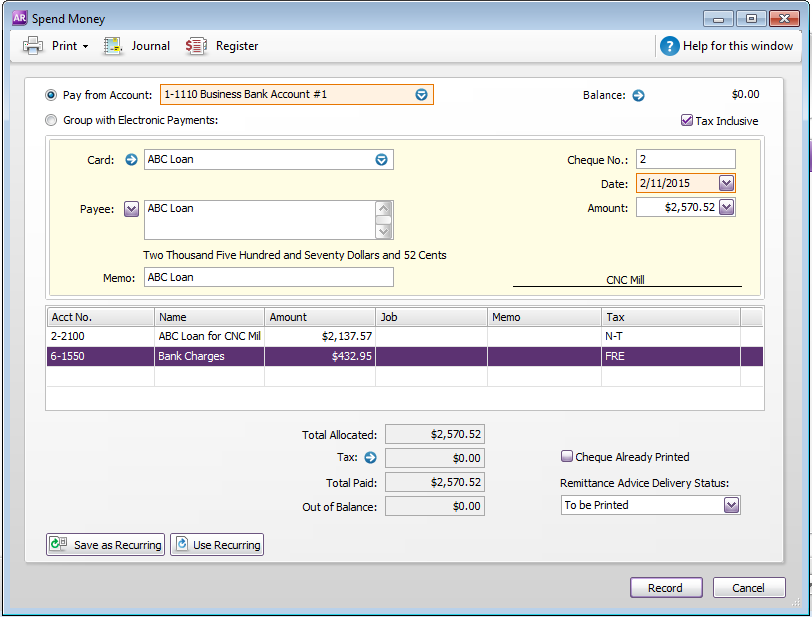

- Create a Spend Money transaction, selecting your bank account as the ‘Pay from Account’

- The payment should show the repayment amount for the loan, including the establishment fee (if applicable). In our example, this would look like the following:

2-2100 ABC Loan $2137.57 N-T

6- xxxx Bank Charges $432.95 FRE

Note:

If you have a complete schedule from the finance company, it can be entered as:

2-2100 ABC Loan $500.00 N-T

2-2105 Unexpired Interest $1508.08 N-T

6- xxxx Bank Charges $432.95 FRE

This method means that you have to make changes every month reflecting the principal/interest. You may be more comfortable leaving this adjustment to the accountant come EOFY, as it does not affect your day-to-day reporting.

Making the second (and the next 46) payments

- These can be made following either of the above examples, minus the bank charges.

- It is better to wait until the money has come out of the bank and either picked up by bank feeds or shown on a statement to create the Spend Money transactions.

- If the finance company imposes fees for late payment, these should be allocated to a Bank Charges account. Penalty Interest should be allocated to an Interest Expense account – normally a 9-xxxx.

Making the final payment

- Confirm with the loan company the amount of the final payment - it should be the net amount on the loan minus the unexpired interest.

- After the final payment is made, any amount on the loan account should equal the Unexpired Interest, but in opposite direction. Payment from the Loan to Unexpired Interest should zero both lines.

HANDLING MOTORISED VEHICLES

All motorised vehicles have a relatively short depreciation period compared to plant and equipment so are separated on the accounts list. There are also different ways of writing down the value of a motor vehicle, so seek the advice of your accountant.

In recording any vehicle purchase, remember to record the Vehicle Identification Number (VIN) as it may be required for audit purposes. Other items that should form part of your record are the make, model, colour and registration number.

Trucks, off-road vehicles, tractors, fork lifts, trailers and vehicles that are not passenger vehicles can be treated in the same manner as the equipment entries we used in the example above.

This is also true of motor vehicles with a purchase price less than the Luxury Car Tax threshold. However, consideration should be given to the balloon, which seems to be an increasingly common means of writing loans for motor vehicles.

The Balloon

The balloon refers to the amount remaining after the number of payments specified in the contract has been paid. This amount needs to be paid back to the finance company to finalise the loan agreement. It is generally less than the written down value of the vehicle at the completion of the loan. Commonly, the balloon is rolled into a new loan figure as the vehicle is changed for a later model. Any loan document must specify the amount of the balloon at the completion of the loan.

Below are the accounts required for a loan with a balloon:

1-xxx0 M-V at Cost

1-xxx5 M-V Accum Dep

2- xxx0 XYZ Loan M-V

2- xxx5 XYZ Loan Unexp. Int.

2-xx10 XYZ Loan – Balloon

As with equipment loans, the loan is set up as a Credit Card type account.

Using either Spend Money or Purchase and Pay Bill transactions, the vehicle is paid for from the loan account.

Using Spend Money, the balloon is paid to the 2-xx10 account.

The balance of the figure is then paid, using a Spend Money transaction, from the Loan Account to the Unexpired Interest Account.

Deposits Paid

Most car traders require a deposit to be paid by the owner/director. This becomes the first payment to the motor vehicle cost. On some occasions, this is included in the payment from the loan company and the deposit refunded by the car trader. The deposit should show as coming from and returning to the Director’s Loan account.

Trade In

A trade in is seen as a sale from your business to the car trader and must be acknowledged as such. It is normally recorded as an Other Income type account (8-xxxx Sale of Assets) with funds flowing to and from the Undeposited Funds account or another clearing account.

If you are trading in a vehicle that is above the Luxury Car Tax Threshold (see below), there are rules that need to be followed and are outside the scope of these notes.

Luxury Car Tax Threshold

The government has determined that the vehicles over a certain value cannot be written off as a business expense.

For the 2016 financial year, the Luxury Car Threshold is $63,184, or $75,375 for a fuel efficient vehicle.

There are some exceptions to the application of the threshold. Most notable are utilities, emergency vehicles, vehicles specifically modified for use by disabled drivers/passengers, and vehicles purchased by registered charities. Any LCT 4-door utility should be discussed with your accountant and/or the ATO.

Anything outside the LCT threshold cannot be claimed and the CAP figure should be 1/11th of the LCT limit.

This means that if there is a loan supporting this purchase, the first $63,184 can be paid from the loan towards the vehicle as CAP. The unexpired interest and any balloon considerations should also be paid from the loan account. The remainder of the loan should be paid to the Director’s Loan account and this account used to pay the remainder of the vehicle, coded N-T.

I understand this is a very vast and complex topic. I have opted to concentrate on Chattel Mortgage, being the most common form of financing. And included a brief description of the difference between the various forms of finance.

Should you need any further information on anything covered in this article, or would just like to chat about finance, please comment below. I’d be happy to discuss.

Happy reading!!

Ron Boulton

BAS Group

1300 BAS GRP (1300 227 477)

ron@basgroup.com.au