Creating Witholding tax 5%

Hello everyone. If anyone can help me out how to create the tax code on MYOB v19 and briefly explain how it works. Since we are not allowed to include such tax on the invoices and this cause the underpayment of trade debtors account accumulated. How can we fix this, please? Looking forward to hearing your swift response.

Hi Erisam

Thank you for your post.

Tax codes are used to track tax paid to and by your business. Each code represents a particular type of tax.

AccountRight has an extensive list of codes that can be used in a variety of situations—for example, when doing business with overseas customers, when tracking capital acquisitions, and so on. If you need help with the tax codes applicable to your business, I do recommend seeking advice from your accounting advisor or the ATO.

In terms of creating a tax code:

- Go to the Lists menu and choose Tax Codes. The Tax Code List window appears.

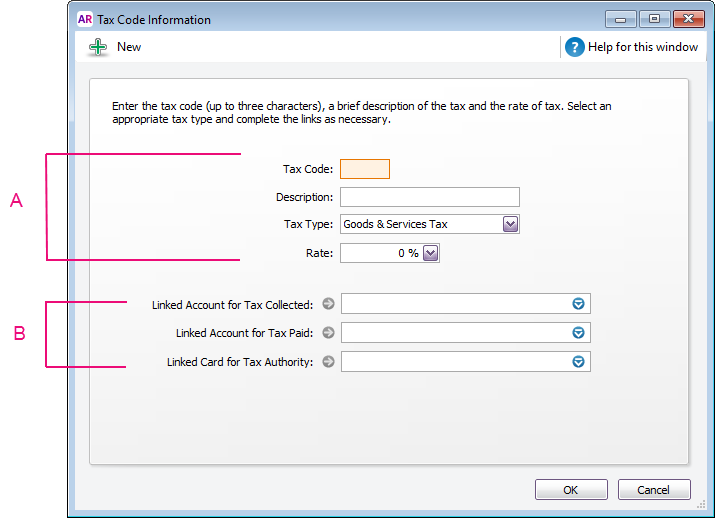

- Click New. The Tax Code Information window appears.

- In the Tax Code field, type a code (up to three characters) for the new tax and press Tab.

Complete the other fields in this window.

A Enter a description, type and rate. If you selected Consolidated as the Tax Type, see Consolidated tax codes. B Select the linked account for tax collected and for tax paid. These fields are only available for some tax types. Check with your accounting advisor if you're not sure which accounts to choose Please let us know how you get on and if you have any further questions.