Thank you for visiting our Partner Zone. This area is an exclusive space for MYOB Partners. Find out how to Partner with MYOB.

- MYOB Community

- MYOB Business

- MYOB Business: Getting Started

- MYOB Business: Sales and Purchases

- MYOB Business: Banking

- MYOB Business: Payroll & MYOB Team

- MYOB Business: Accounting & BAS

- MYOB Business: Reports

- MYOB Business: Inventory

- AccountRight

- The AccountRight Blog

- AccountRight: Getting Started

- AccountRight: Sales and Purchases

- AccountRight: Banking

- AccountRight: Payroll

- AccountRight: Accounting & BAS

- AccountRight: Reports

- AccountRight: Inventory and Multi Currency

- AccountRight: Import/Export & Integrations

- New Zealand

- New Zealand Payroll

- New Zealand GST

- MYOB Advanced

- Advanced: Finance

- Advanced: Sales and Purchases

- Advanced: Staff and Payroll

- Advanced: Construction

- Advanced: Dashboard and Reporting

- Advanced: Integrations and Customisations

- Advanced: General

- MYOB EXO

- MYOB EXO Business

- MYOB EXO Employer Services

- More

- Other MYOB Software

- Product Ideas

- MYOB Business Browser Ideas

- Desktop Ideas

- Accountants & Bookkeepers

- Admin Tasks & General Discussions

- MYOB Accountants Office & Accountants Enterprise

- MYOB Practice (PM/DM)

- MYOB Practice BAS

- Forum Hub

- Welcome to the Community

- MYOB Announcements

- Students & Educators

- Student-Hub

- MYOB Learning Library & Links

- MYOB Community

- >

- AccountRight

- >

- AccountRight: Payroll

- >

- Re: Payroll Activity Report

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Payroll Activity Report

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

a month ago

a month ago

Payroll Activity Report

Hi,

We have an issue with the Payroll Activity Summary Report including categories such as Payroll Advances and Employee Reimbursements - these payments are NOT wages and therefore should not appear under the wages coloumn of the report.

When verifying the data in the STP report each week after the payrun there is a discrepency as the MYOB Payroll Activity report is including these types of categories as wages.

We cannot see anyway for these categories to not be included in this report and the MYOB instructions direct you to setup using the wages category.

Either there needs to be an additional Payroll Category Type OR there needs to be an option for them not to be included in the Wages Category report.

Any help greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

a month ago

a month ago

Re: Payroll Activity Report

Hi @aiw,

Thanks for your post.

If there are payroll categories that should not be included in the Payroll Activity Summary report and this is causing the discrepancy between figures, you may need to check the ATO reporting category used. As the payroll reports only base their figures on how you report each payroll category. For more information on how to change the ATO reporting category, please see the Help Article: Assign ATO reporting categories for Single Touch Payroll reporting.

Once changes have been made, make sure to send an update event so that the up-to-date figures will be received by the ATO. To do this, check the Help Article: End of year finalisation with Single Touch Payroll reporting for more information.

Feel free to post again anytime if you require further assistance.

If my response has answered your inquiry, please click "Accept as Solution" to assist other users in finding this information.

Best regards,

Doreen

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Accept it as a Solution

Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

a month ago

a month ago

Re: Payroll Activity Report

Hi Doreen,

Thanks for your response, however it appears you have misunderstood my orignal post.

Reimbursements and Payroll Advances are NOT wages, however the MYOB documentation instructions to use the Payroll Category of Wages. They are not ATO reportable therefore that option is not selected.

Kindly please review and advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

a month ago

a month ago

Re: Payroll Activity Report

Hi @aiw,

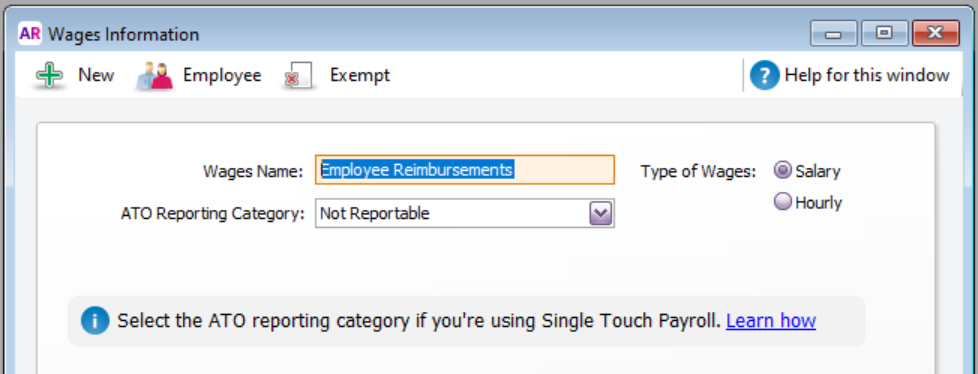

Thanks for your response. Could you please provide a screenshot and verify the setup for reimbursements and payroll advances? If these items are not classified as wages, ensure they are categorized as "not reportable" in the ATO reporting category.

Regards,

Earl

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Accept it as a Solution

Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

a month ago

a month ago

Re: Payroll Activity Report

Hi @Earl_HD,

Attached screenshot shows that ATO category is Not Reportable (which is working correctly).

When you run a Payroll Activity report from MYOB these values are showing up under 'Wages" however these amounts should not appear as a "Wage" as they are not a wage.

When cross referencing the ATO figures against MYOB it then indicates there is a discrepency until you manually calculate the value of Reimbursements and Pay Advances and remove that from the wages total (which you shouldnt have to do).

Look forward to your reply.

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

a month ago

a month ago

Re: Payroll Activity Report

Hi @aiw,

Thank you for your response and your patience in waiting for a response.

Payroll categories marked as not reportable will still appear in the payroll activity and register report. However, they will not be included in the YTD verification report. When finalizing and sending reports like the YTD verification report and Summary of Payments to the ATO, the YTD amounts are pulled from the employee card's Pay History, filtered by the ATO reporting categories. For detailed information, please refer to this help page: Assign ATO reporting categories for Single Touch Payroll reporting.

Feel free to post again, we're happy to help!

If my response has answered your enquiry please click "Accept as Solution" to assist other users find this information.

Regards,

Earl

Online Help| Forum Search| my.MYOB| Download Page

Did my answer help?

Accept it as a Solution

Leave a to tell others

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

a month ago

a month ago

Re: Payroll Activity Report

Hi Earl,

Thanks for your response however, the core issue here is that payments such as Reimbursements and Wage Advances are recorded under the Wages Category (which is the only option) however, these are not Wages - there should be another category available such as 'Other Payments' so that they are not confused with being wages.

When a Payroll Activity report is generated from MYOB, the wages column shouldn't show these amounts as they do not form part of an employee's wages.

The Payroll Activity report should be able to match the amounts in the STP report.

Hope this clarifies the issue.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

a month ago - last edited a month ago

a month ago - last edited a month ago

Re: Payroll Activity Report

Hi @aiw,

Thank you for your response.

I understand your concern about the categorization of reimbursements and wage advances in the Wages category. You're right! These are not wages and should be treated differently. However, in MYOB, the Reimbursement and Wage advance are set to be under the wage category.

The payroll activity report shows this as wage column amounts, as they form part of the payroll categories. Even though this is shown in this report, this doesn't necessarily mean that it will show up in your YTD report too. As for the year-to-date (YTD) verification report, it only gets its data from the employee card under the Payroll Details tab and Pay History. It filters this data by the ATO reporting categories.

Feel free to create a new post again if you need help in the future.

If my response has answered your inquiry, please click "Accept as Solution" to help other users find this information.

Cheers,

Princess

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

4 weeks ago

4 weeks ago

Re: Payroll Activity Report

Thanks Princess,

Appreciate you getting back to me, can this perhaps be passed onto the development or product team for review?

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

4 weeks ago

4 weeks ago

Re: Payroll Activity Report

Hi @aiw,

Thanks for your response.

To ensure your suggestion reaches the right people, I recommend you to submit it to our AccountRight Ideas Exchange board. This platform is specifically designed for users to share their ideas and suggestions for improvements and enhancements in MYOB.

Feel free to create a new post again if you need further help in the future.

If my response has answered your inquiry, please click "Accept as Solution" to help other users find this information.

Cheers,

Princess

Didn't find your answer here?

Related Posts

|

1

|

183

|

|||

|

7

|

850

|

|||

|

1

|

199

|

|||

|

1

|

651

|

|||

|

2

|

421

|