AG23

2 years agoContributing User

STP - Reverse pay issue

Dear team, I have done a payrun on 23rd of June, 2023 and then i have done the reverse pay also for the same. But this is not reflecting in the Single Touch Payroll reporting ? Can you ple...

- 2 years ago

Hi AG23

Thanks for your post.

Generally, To reverse a payroll transaction:

- Go to Find transaction, find that pay transaction and open it by clicking the zoom arrow

- Click on edit and select Reverse Transaction.

- If the pay being reversed is a cheque or electronic payment, a message will be displayed advising it will be recorded as cash. Click YES to proceed

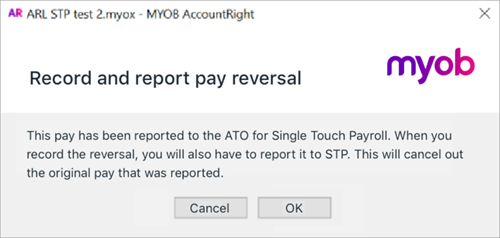

- Click OK to the following confirmation message.

- Click Record to process the reversal

- When prompted to declare the reversal to the ATO, enter the name of the Authorized sender and click send.

You can find these step by step instruction in this Help Article: Changing a recorded pay

If the reverse transaction did not appear in Single Touch Payroll Reporting you check the Transaction Journal where you can find your reverse transaction.

I hope this helps and let me know how it goes. I'm happy to assist you further.

Are you satisfied with the response provided?

Regards,

Cel