Tax File Declaration

Hi there,

How can I check that an employee's TFN Declaration Form has been successfully submitted to the ATO?

Thanks!

Hi YPK,

Thank you for your post.

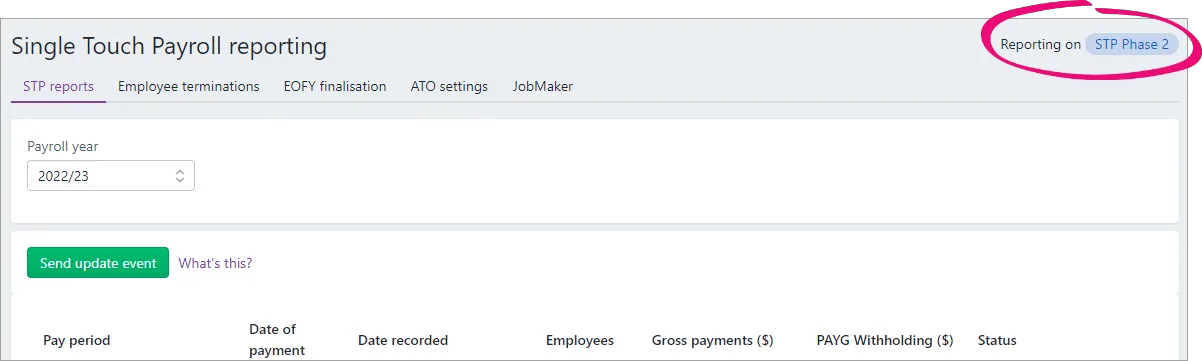

Under STP Phase 2, when a new employee joins your team, you won't need to send the ATO a tax file number declaration. Instead, information on how employees can self-onboard is available in our help article titled "Employee Self-Onboarding." It's important to note that until you transition to STP Phase 2, you'll still need to send TFN declarations to the ATO for new employees.

Once you've moved to STP Phase 2, a new employee's tax details will be automatically sent to the ATO when you declare their first pay run from AccountRight. This means you won't have to manually submit a TFN declaration. However, if you want to verify whether the TFN declaration form was successfully submitted to the ATO, I recommend reaching out to ATO directly for confirmation.

Feel free to post again if you need further assistance.

If my response has answered your inquiry, please click "Accept as Solution" to help other users find this information.

Cheers,

Princess