Wages for 1 employee missing on W1 and W2

Hi

One of the employees wages do not pull through to the BAS and IAS for a client and these have all lodged

without this employee's information.

The ATO reporting category is set up correctly and in the BAS settings these are showing 'salary'

which is what she is on

Would anyone have an idea where else I can check in the system to see why her info is not pulling through into the forms.

Hi ShieldBooks

Does the employee who's wages are missing have a different pay category from the other employees?

If so, you might like to check that that employee's category is setup correctly in your BAS/IAS setup.

If you lodge your BAS/IAS manually:

Go to the PAYG-W section of the BAS/IAS and click the [Setup] button next to the W1 figure. Ensure that this employee's pay category is ticked.

If you lodge your BAS/IAS using the Online method

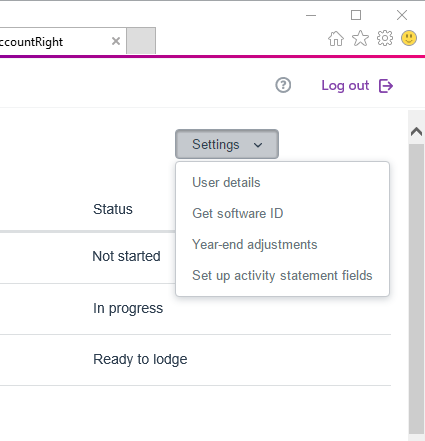

If you need to change your tax code setup, authorised person, or change how year-end adjustments recorded in AccountRight affect your BAS:

- Open your AccountRight online company file.

- Click Prepare BAS/IAS in the Accounts command centre.

- In the Lodge Online tab, click Prepare Statement.

- Click the Settings option.

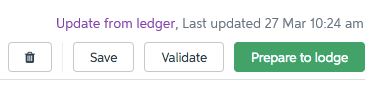

If you change the tax code setup, it will not affect any returns that are already in progress. You’ll need to open the statement that’s in progress, choose to Edit it, and then click Update from ledger, to use the new tax code setup details.

Note that doing this will replace the values of all fields that are automatically calculated based on the tax code setup.

Hope this helps,

AlanT